Shopping cart

Your cart empty!

Zurich, June 20, 2024 — The Swiss National Bank (SNB) has decided to cut the benchmark Sight Deposit Rate by 25 basis points (bps), lowering it from 1.50% to 1.25%. This decision follows the SNB's quarterly monetary policy assessment, announced on Thursday, and aligns with market expectations.

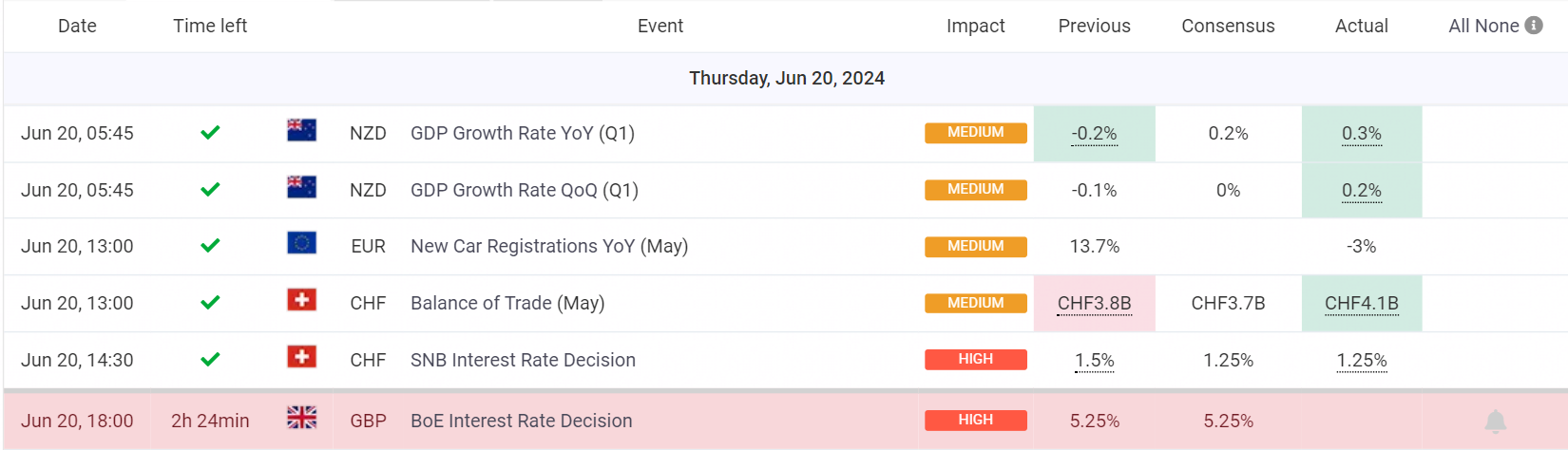

Economic Calendar on 20/06/24

This move marks the second consecutive rate cut by the SNB, following a surprise 25 bps reduction in March, which brought the rate to 1.50%. The March cut was notable for making the SNB the first major central bank to ease its monetary policy after a period of tightening.

In response to the anticipated rate cut, the USD/CHF currency pair saw a significant jump of over 50 pips, testing the 0.8900 level. The pair is currently up by 0.53% on the day, reflecting the market's reaction to the SNB's decision.

The SNB's actions come amid a backdrop of global economic uncertainty and fluctuating market conditions. The rate cut aims to support the Swiss economy by making borrowing more affordable and stimulating investment and spending. As central banks worldwide navigate the delicate balance between fostering growth and controlling inflation, the SNB's policy shift will be closely watched by economists and market participants alike.