Shopping cart

Your cart empty!

The price of gold (XAU/USD) continues to rise above $2,180, hitting new record highs of nearly $2,200 in the early Asian trading on Monday. This surge is fueled by expectations that the Federal Reserve (Fed) may reduce interest rates this year, providing support for gold. Geopolitical tensions also contribute to the increase in demand for the safe-haven asset.

During last week's semiannual testimony on Capitol Hill, Fed Chair Jerome Powell indicated that the US economy is strong, and policymakers are nearing the point of confidence in the decline of inflation, potentially leading to rate cuts. Futures markets suggest a 70% chance of rate cuts starting by mid-June, with expectations of a full percentage point cut by year-end, according to CME FedWatch Tools.

Data released by the Labor Department on Friday showed that the US economy added 275,000 jobs in February, surpassing estimates of 200,000. However, the Unemployment Rate rose to 3.9% in February from 3.7% in January, its highest level in two years. This mixed report has raised the possibility of Fed rate cuts by June.

China's inflation report on Saturday indicated a return to normal consumption levels, signaling increased domestic demand in the world's largest gold-consuming nation. The Chinese Consumer Price Index (CPI) rose by 0.7% year-over-year in February, exceeding expectations of a 0.3% increase, while the Producer Price Index (PPI) declined by 2.7% year-over-year in February, worse than expected and the previous reading of a 2.5% decline.

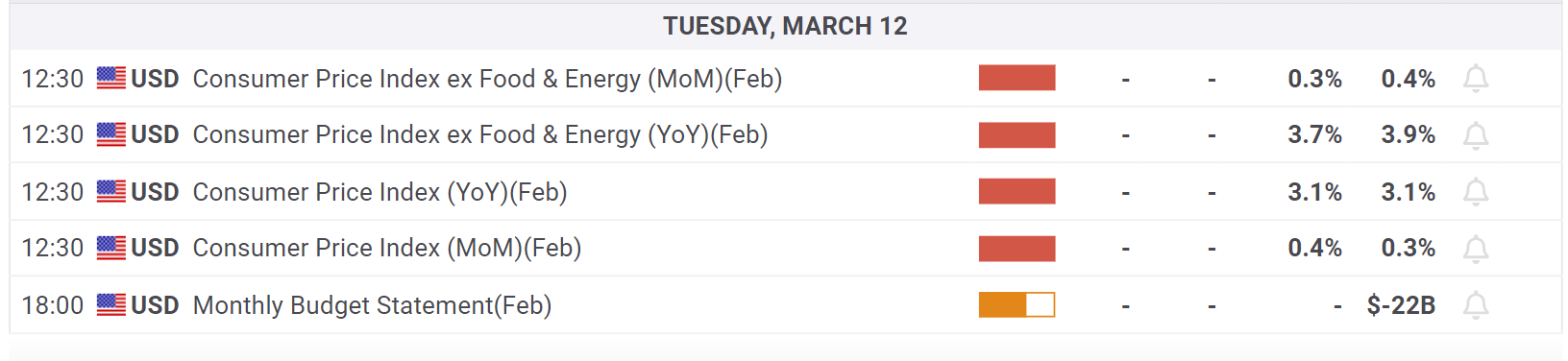

Up coming US high impact news

Source: https://www.fxstreet.com/