Shopping cart

Your cart empty!

Investors are eagerly awaiting the release of a critical inflation report today (Tuesday). This report, from the U.S. Bureau of Labor Statistics, will detail February's consumer price index (CPI). This information is crucial for understanding current inflation trends and will likely influence the Federal Reserve's upcoming decisions on interest rates.

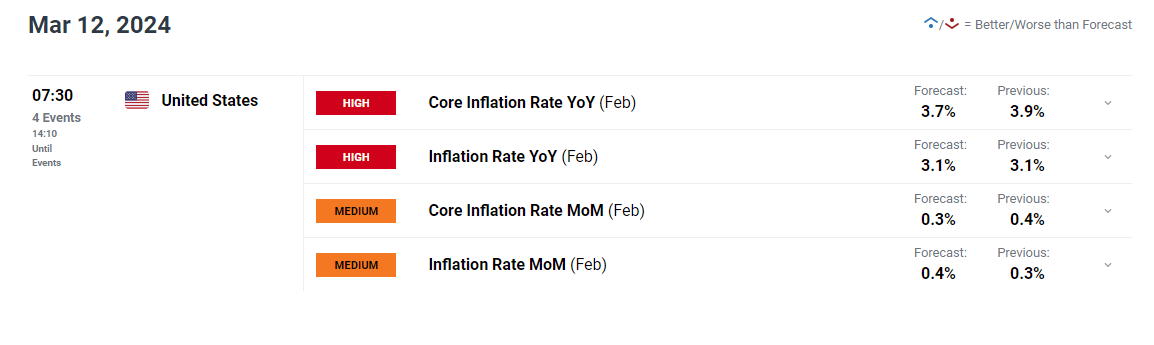

Experts predict a slight increase (0.4%) in overall prices last month, driven by higher energy costs. This would hold the annual inflation rate steady at 3.1%. On the other hand, core inflation, which excludes volatile items like food and energy, is expected to see a small decrease to 3.7% year-over-year, down from 3.9%.

Source: DailyFX Economic Calendar

If the inflation report comes in worse than expected (hotter), it would suggest inflation isn't slowing down as much as hoped. This could mean inflation is picking up speed again and will be tougher to control. In reaction to this, the Federal Reserve might need to adjust its plans and become more aggressive in raising interest rates (hawkish). This could lead to higher bond yields and a stronger dollar. As a result, stock prices and gold could potentially fall.

If the inflation report comes in better than expected, it would be good news for investors. It would suggest that inflation is actually under control and decreasing, not just a blip. This could make the Federal Reserve more confident that they're on the right track to bring inflation down to their target level of 2%. As a result, investors might expect the Fed to cut interest rates multiple times this year, possibly starting in June.

In this scenario, interest rates on bonds (yields) and the value of the US dollar would likely go down further. This could be positive for gold prices and stocks (risk assets) in the coming weeks and months.

Source: https://www.dailyfx.com/