Shopping cart

Your cart empty!

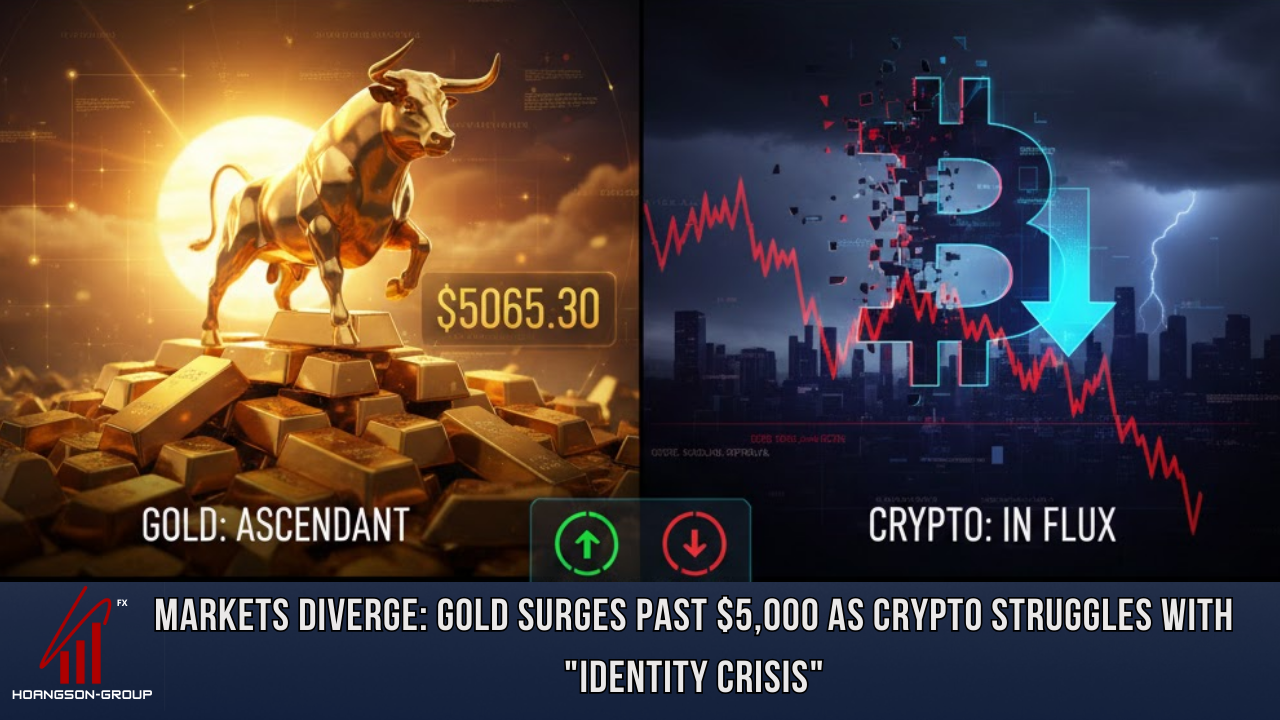

LONDON / NEW YORK — The global financial landscape has entered a period of sharp "decoupling," with traditional safe-haven assets and digital currencies moving in starkly opposite directions. As of February 11, 2026, gold has solidified its position as the premier store of value, while the cryptocurrency market faces mounting regulatory pressure and institutional exits.

Physical bullion has firmly reclaimed its status as the world’s preferred hedge. Gold is currently trading steadily above the $5,000 per ounce mark, supported by a "perfect storm" of economic factors:

Central Bank Accumulation: The People’s Bank of China has extended its buying streak to 15 consecutive months.

Cooling U.S. Economy: Soft consumer spending data has led investors to price in multiple Federal Reserve rate cuts.

Technical Stability: After hitting a lifetime high of $5,626, the metal has found a robust floor at $5,065.

While gold shines, Bitcoin (BTC) is struggling to maintain its "digital gold" narrative. Currently hovering around $69,000, the asset is behaving more like a high-risk tech stock than a safe haven.

Sentiment was further dampened this week by a massive "Bitcoin misallocation error" at South Korea’s Bithumb exchange, sparking an intensive government investigation. Consequently, institutional traders are deleveraging, with Bitcoin futures seeing billions in open interest evaporate as capital rotates back into precious metals.

Stock markets are reflecting a "patchy" earnings season, characterized by a shift from growth to value:

Dow Jones: Crossed the historic 50,000 milestone, powered by the energy and financial sectors.

Nasdaq: Underperformed due to a sell-off in software stocks, as investors weigh stretched AI valuations against potential disruption.

Global Growth: India’s Nifty 50 is nearing record levels at 26,000, signaling a broader appetite for "old economy" sectors like materials and industrials.

"The 'store of value' crown has been firmly reclaimed by physical bullion," noted one market analyst. "Digital assets now face a structural test to prove their resilience in an increasingly volatile environment."

Investors are now bracing for a "data-heavy" window. Upcoming U.S. non-farm payrolls and inflation reports are expected to be the ultimate litmus tests for the Federal Reserve’s interest rate trajectory. The core question remains: is the current crypto slump a temporary correction, or a fundamental shift in how the market defines risk?