Shopping cart

Your cart empty!

The GBP/USD currency pair has stabilized near 1.2600, recovering some ground after a steep decline of over 1% following the Federal Reserve's hawkish stance earlier in the week. Market attention now shifts to the Bank of England's (BoE) upcoming rate decision, where no change in interest rates is widely anticipated.

Earlier this week, GBP/USD corrected its sharp losses from the previous week, closing positively on Monday. By Tuesday’s European session, the pair held steady around 1.2700, supported by stronger-than-expected labor market data from the UK.

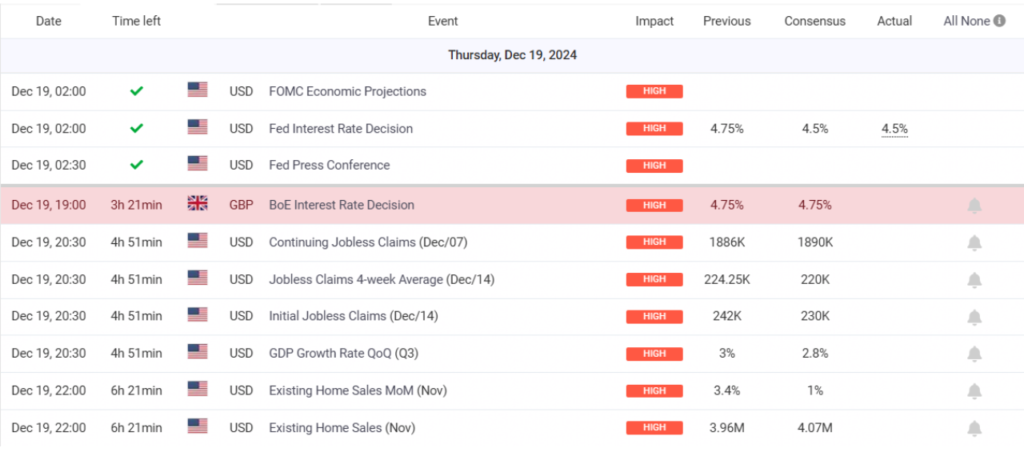

ECONOMIC CALENDAR ON 19/12/24

According to the Office for National Statistics (ONS), the UK’s ILO Unemployment Rate remained unchanged at 4.3% for the three months ending in October, in line with forecasts. Meanwhile, employment levels rose by 173,000, and annual wage growth excluding bonuses increased to 5.2%, up from 4.9%, indicating resilience in the labor market.

Despite a risk-off sentiment boosting the US Dollar, GBP/USD has managed to maintain its footing following the labor market report. However, later in the day, US Retail Sales data for November, expected to show a 0.5% monthly increase, could influence the pair. Market reactions to this data might be muted ahead of the Federal Reserve’s monetary policy announcement.

Looking ahead, the UK’s Consumer Price Index (CPI) for November will be released on Wednesday morning, offering further insight into inflation trends ahead of the BoE’s decision. The CPI data could provide additional volatility for GBP/USD as traders weigh its implications for the UK economy.