Shopping cart

Your cart empty!

The EUR/USD currency pair maintained its position near the 1.0500 level during Wednesday’s European trading session, with gains remaining limited as investors exercised caution ahead of the U.S. Federal Reserve's monetary policy announcement.

On Tuesday, the pair stayed within familiar territory, stabilizing around the 1.0500 mark. Market sentiment was subdued, influenced by upcoming central bank decisions and key economic data releases. The U.S. Dollar (USD) initially gained strength but lost momentum following the release of lackluster U.S. economic indicators.

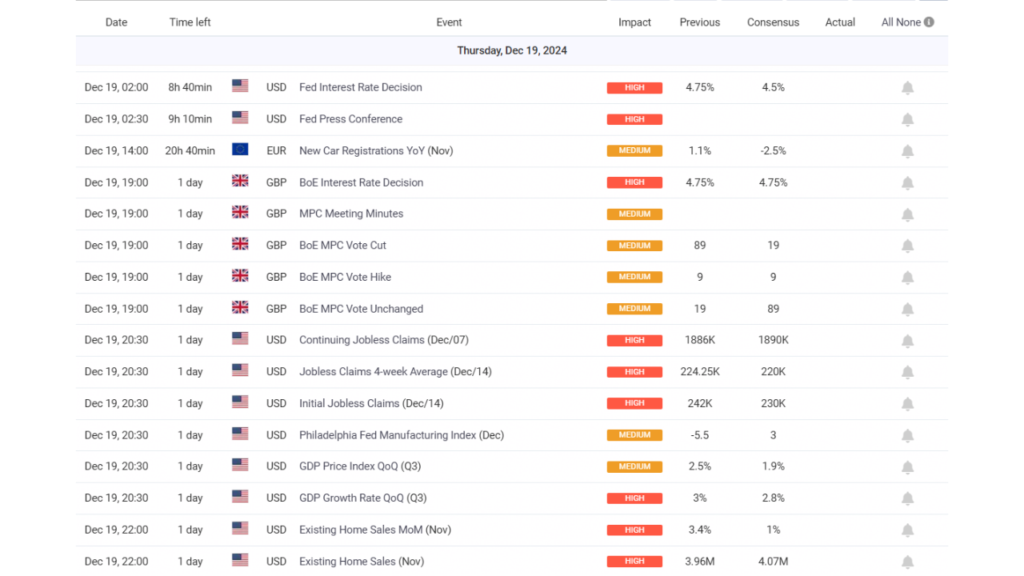

ECONOMIC CALENDAR ON 19/12/24

In the Eurozone, the October Trade Balance showed a non-seasonally adjusted surplus of €6.8 billion, a decline from September’s €11.6 billion. Meanwhile, Germany’s ZEW Economic Sentiment index for December improved significantly, rising to 15.7 from November’s 7.4. These figures provided temporary support for the Euro, though the upward momentum was short-lived.

In the U.S., November Retail Sales outpaced expectations, rising by 0.7% compared to the forecasted 0.5%. However, other data painted a mixed picture: Capacity Utilization fell to 76.8%, below the 77.3% estimate, and Industrial Production declined by 0.1% instead of the anticipated 0.3% increase.

All eyes are now on the Federal Reserve, which is widely expected to reduce its benchmark interest rate by 25 basis points (bps) in its upcoming policy announcement. Alongside the rate decision, the Fed will release its Summary of Economic Projections (SEP), providing insights into future expectations for growth, inflation, employment, and interest rate trajectories.