Shopping cart

Your cart empty!

The Australian Dollar (AUD) trimmed its earlier losses against the US Dollar (USD) on Wednesday after the release of key economic data. Australia's Gross Domestic Product (GDP) grew by 0.2% quarter-over-quarter (QoQ) in the second quarter, improving from the previous quarter's 0.1% growth but missing the expected 0.3% increase. Meanwhile, China's Services Purchasing Managers' Index (PMI) declined from 52.1 in July to 51.6 in August, reflecting a slowdown in the sector, which is significant given the close trade ties between China and Australia.

Support for the AUD/USD pair may have been bolstered by Australia's upbeat August Purchasing Managers Index (PMI). Market participants are now closely monitoring the upcoming speech by Reserve Bank of Australia (RBA) Governor Michele Bullock on Thursday, seeking further insights into the central bank's stance on monetary policy.

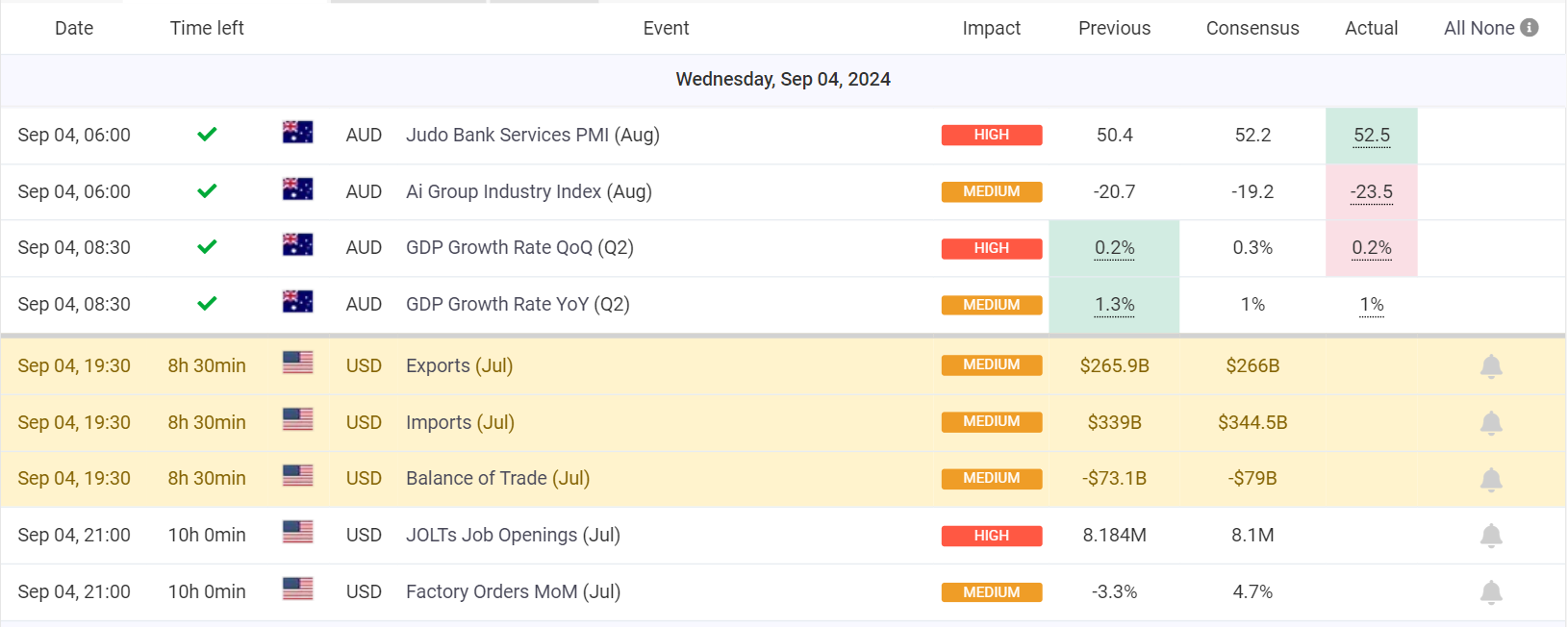

Economic Calendar 04/09/2024 by Myfxbook

In contrast, the US Dollar found support as investors assessed the broader economic outlook. The ISM Manufacturing PMI showed that factory activity contracted for the fifth month in a row, with the decline slightly outpacing expectations, raising fresh concerns about the impact of high interest rates on the US economy.

Traders are now looking ahead to additional economic reports this week, including the ISM Services PMI and Nonfarm Payrolls (NFP), which could provide further clues about the likelihood of a rate cut by the Federal Reserve later this month.