Shopping cart

Your cart empty!

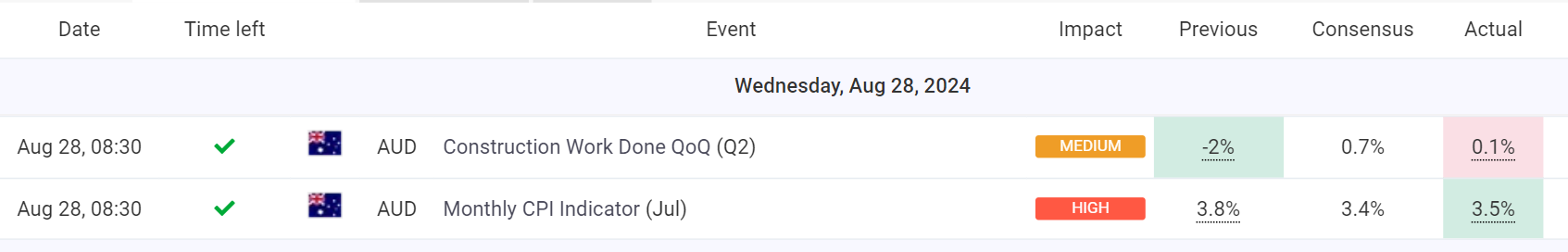

The Australian Bureau of Statistics (ABS) reported on Wednesday that Australia's monthly Consumer Price Index (CPI) rose by 3.5% in the year leading up to July, down slightly from the 3.8% increase recorded in June. This figure exceeded market expectations, which had predicted a 3.4% rise.

ECONOMIC CALENDAR 28/08/2024 (Myfxbook)

Following the release of the CPI data, the AUD/USD saw a temporary retreat, trading near 0.6800 in Asian markets after reaching a seven-month high of 0.6813. Despite a brief pullback, the Australian Dollar (AUD) regained momentum, buoyed by the higher-than-expected inflation figures.

The data suggests that while inflation in Australia is cooling, it is doing so at a slower pace than anticipated. This has reignited expectations of further interest rate hikes by the Reserve Bank of Australia (RBA), which in turn provided a lift to the AUD.

However, the Aussie’s gains were limited by a cautious market environment, which increased demand for the safe-haven US Dollar (USD). The global market is also on edge as traders await the earnings report from US tech giant Nvidia, alongside upcoming speeches from US Federal Reserve (Fed) officials, which could provide further insight into the potential for rate cuts in September.

Looking ahead, the AUD/USD pair will likely remain influenced by USD movements and broader market sentiment. Traders are also anticipating Thursday’s release of Australia’s Private Capital Expenditure (Capex) data for the second quarter.