Shopping cart

Your cart empty!

The price of gold (XAU/USD) surged this week, reaching its highest level since December 2023. By the end of Friday, gold had gained a significant 2.33% for the week, settling near $2,082. This upward trend is likely due to a decrease in US Treasury yields. Investors were unsure about the Federal Reserve's next move after two important economic reports came out. The core PCE deflator, the Fed's preferred measure of inflation, met expectations at 0.4% for the month and 2.8% for the year. This relieved investors who were worried about even higher inflation after recent data showed strong price increases.

Recent data suggests the U.S. economy might be weakening. Disappointing manufacturing data indicates a potential slowdown, leading some to believe the Federal Reserve may loosen its monetary policy sooner than anticipated. This shift in expectations, reflected by a potential decline in interest rates, could significantly impact gold prices. If upcoming jobs data confirms economic strength, hopes of a policy shift will fade, potentially pushing gold prices down. However, a weaker jobs report could signal economic trouble, prompting investors to reassess interest rates and potentially boost the price of gold as a safe haven asset.

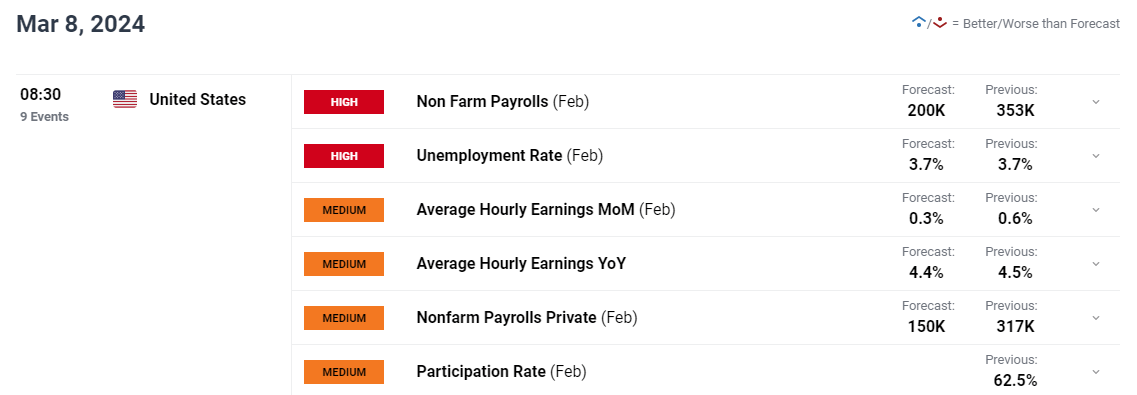

UPCOMING US JOBS REPORT

Source: https://www.dailyfx.com/