Shopping cart

Your cart empty!

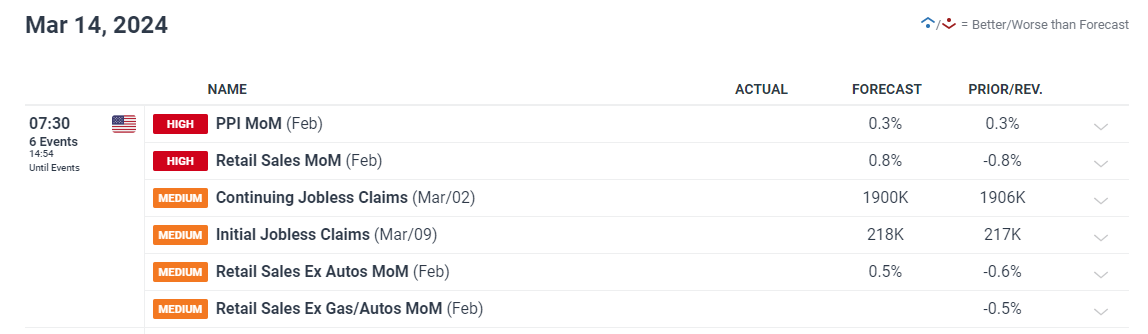

On Wednesday, the US dollar saw a slight decline, although this was moderated by an increase in US Treasury yields. Despite this, foreign exchange (FX) volatility remained low as traders seemed cautious about taking significant positions before important events on the US calendar on Thursday: the announcement of the Producer Price Index (PPI) and retail and food services sales for the month.

Earlier this week, the CPI report exceeded expectations but didn't convince Wall Street that the Federal Reserve might delay policy tightening. However, if forthcoming data continues to indicate high inflation, traders may reconsider the central bank's trajectory.

Source: DailyFX Economic Calendar

Today's release of February's PPI and retail sales figures will provide clearer insights into broader price trends and the state of the US consumer. Another positive surprise in these economic indicators could lead to a realization that inflation risks and economic strength have been underestimated, prompting a more hawkish adjustment of interest rate expectations. This would likely benefit the US dollar.

Source: https://www.dailyfx.com/