The Federal Reserve is expected to announce its monetary policy decision on Wednesday, following the April 30-May 1 meeting. It’s anticipated that the Federal Open Market Committee (FOMC) will keep borrowing costs steady between 5.25% and 5.50% and maintain the existing forward guidance. All focus will be on Fed Chair Powell’s press conference for clues about future policy, especially since there won’t be new economic projections at this meeting.

Given recent economic trends, like slow progress in reducing inflation and a tight job market, Powell might take a more assertive stance. He could suggest that policymakers aren’t confident enough to start easing policy yet and advocate for patience. Inflation has been unexpectedly high lately, with core PCE running at an annualized rate of 4.4% over the past three months.

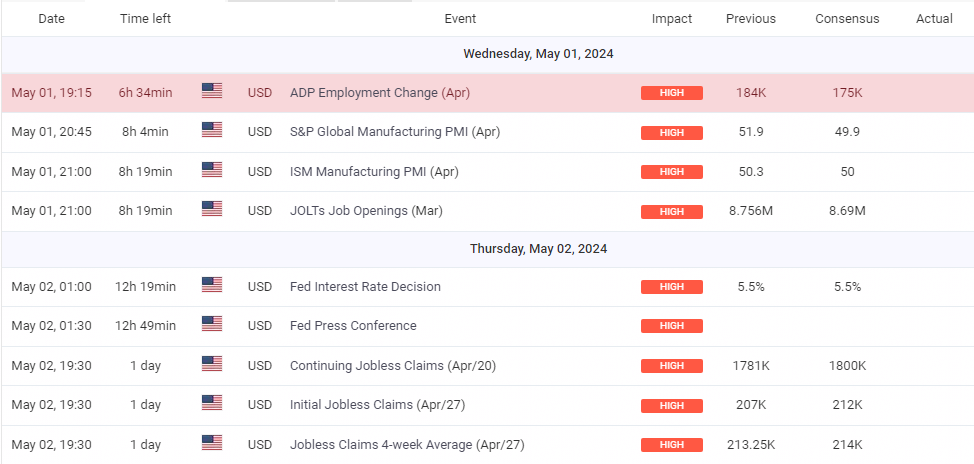

UP COMING HIGH IMPACT NEWS EVENT

(Source: myfxbook)

If there’s a shift towards more hawkish language, it might mean that the 75 basis points of easing forecasted for 2024 in the Fed’s last dot-plot could be off the mark. This might delay rate cuts until late 2024 or even 2025 to avoid a resurgence of inflation. Longer-term prospects of higher interest rates, if confirmed by Powell, could boost U.S. Treasury yields and the U.S. dollar but could dampen gold prices.

Although rate hikes are not the automatic expectation anymore after a 525 basis points tightening from 2022 to 2023, Powell’s responses to questions during the press conference will be closely watched. Any hint that rate hikes might resume or that some officials are considering them would be seen as doubly hawkish, potentially causing increased market volatility and a significant sell-off in risk assets.