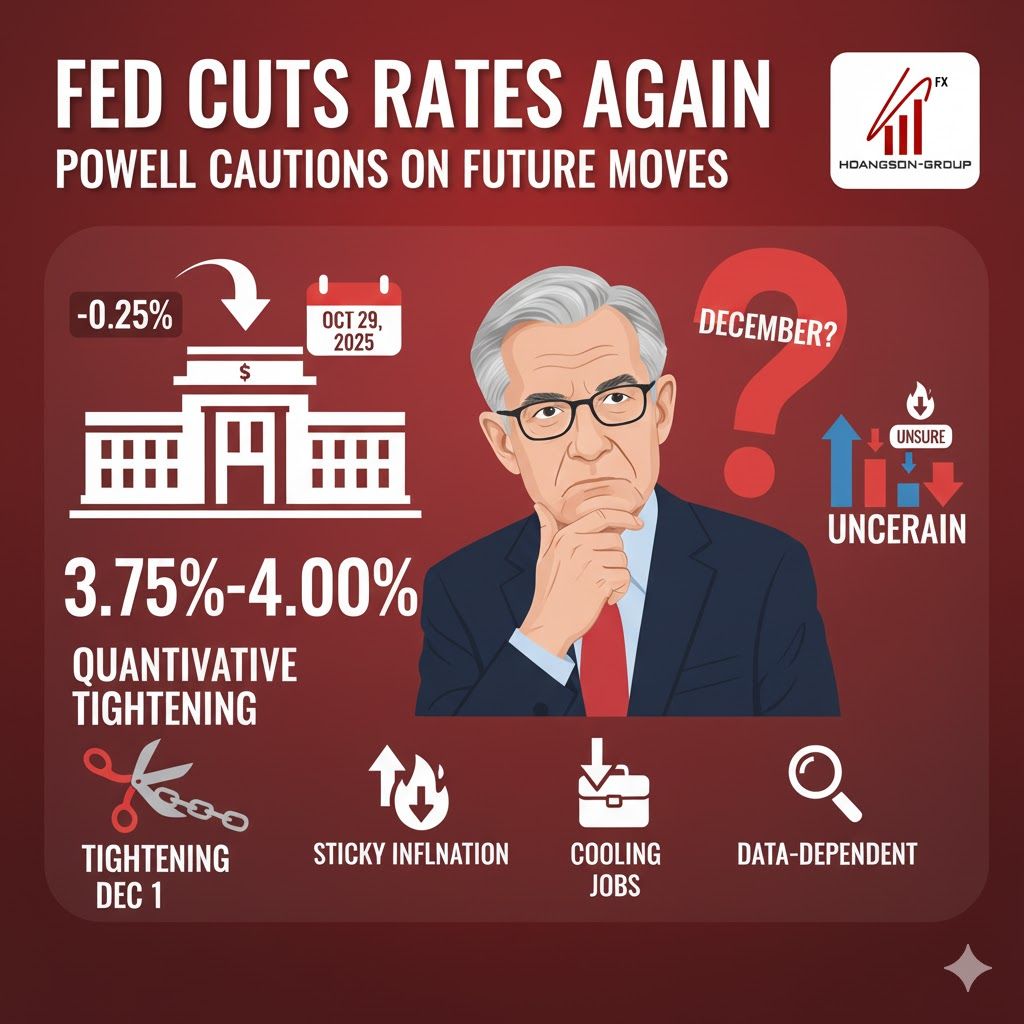

WASHINGTON, D.C. – October 30, 2025 – The U.S. Federal Reserve, led by Chairman Jerome Powell, announced a widely anticipated 25-basis-point (bps) cut to its benchmark interest rate on Wednesday, bringing the new target range to 3.75%-4.00%.

The move marks the central bank's second consecutive rate reduction this year, intended to mitigate risks from a softening labor market, where job gains have slowed and unemployment has edged up. However, the decision was immediately followed by cautionary remarks from Powell, chilling market expectations for further swift easing.

No 'Foregone Conclusion' for December

In his post-meeting press conference, Powell explicitly warned that a third consecutive rate cut in December is "not a foregone conclusion—far from it." He stressed that the path of monetary policy is not on a "preset course" and will remain strictly data-dependent.

The Fed's next decision is complicated by the ongoing government shutdown, which has interrupted the release of critical economic data. Powell acknowledged this lack of complete information could prompt officials to be more cautious at the next Federal Open Market Committee (FOMC) meeting.

Deep Divisions Emerge

The vote revealed growing dissent among policymakers, underscoring the delicate balance the Fed is attempting to strike between supporting employment and controlling inflation.

- The FOMC voted 10-2 for the 25-bps cut.

- One dissenter, Governor Stephen Miran, favored a larger 50-bps reduction.

- Another, Kansas City Fed President Jeffrey Schmid, preferred no change to the rate.

The FOMC statement noted that while economic activity is expanding at a moderate pace, inflation remains "somewhat elevated," and "uncertainty about the economic outlook remains elevated."

Market Reaction and Economic Impact

Markets reacted with measured optimism to the cut itself, which lowers borrowing costs for various loans, including mortgages and auto financing. However, major U.S. stock indexes saw only minor movement, while traders quickly scaled back bets on a December rate cut following Powell's comments.

The rate cut is expected to modestly ease financial conditions for businesses and consumers, though the effects on long-term rates like 30-year mortgages are often more gradual. The Fed is navigating a unique "challenging situation" of sticky, tariff-driven inflation coupled with a cooling job market.

In a separate but related move, the Fed also announced it will end its balance sheet runoff (Quantitative Tightening) on December 1st, a measure expected to improve market liquidity.