Shopping cart

Your cart empty!

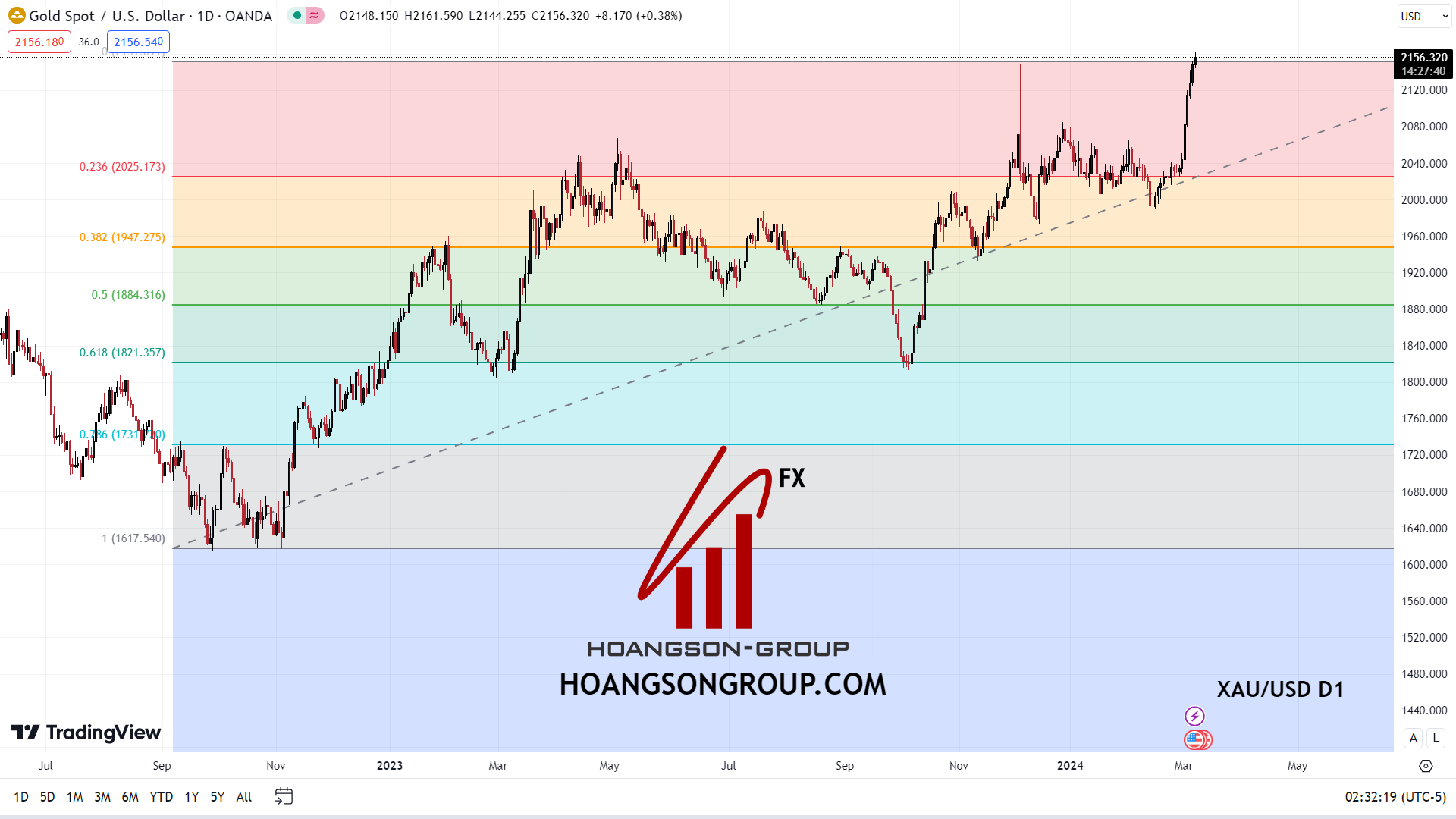

Gold (XAU/USD) extends its rally for a seventh consecutive session, reaching a record high near $2,161 ahead of the European open. Fed Chair Powell's congressional testimony on Wednesday solidified market expectations for an upcoming interest rate cut. This weakens the US dollar (USD) which is near its year-to-date low, acting as a major tailwind for non-interest-bearing gold.

Gold daily chart published by Tradingview.com

Additionally, a risk-off sentiment fueled by geopolitical tensions in the Middle East and concerns regarding a Chinese slowdown bolsters gold's safe-haven appeal. However, dovish comments from Minneapolis Fed President Kashkari, coupled with a slight uptick in US Treasury yields, limited further dollar weakness and capped gold's upside potential. Technical indicators suggest the market is currently overbought on the daily chart.

Source: https://www.fxstreet.com/