On Tuesday, the Reserve Bank of Australia (RBA) opted to maintain the interest rate at its current 12-year high of 4.35%, deflating the hawkish expectations built up in the market. Prior to the meeting, there was a 43% probability priced in by markets for another rate hike in September, but this has now diminished to around 5%.

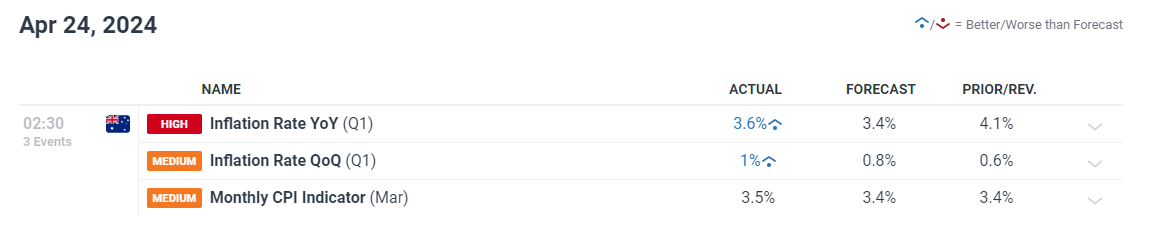

The primary challenge facing the RBA has been the recent uptick in inflation. Inflation measures for both the quarterly and yearly periods in Q1 exceeded expectations, with the March monthly indicator contributing to this trend of unexpected data outcomes. Taming inflation has proven to be a formidable task, with Australia facing particularly daunting circumstances in this regard.

Economic Calendar (Customize and filter on DailyFX)

In a recent statement, RBA Governor Michele Bullock addressed concerns over potential rate hikes due to inflationary pressures. While she indicated a cautious approach and expressed frustration over first-quarter inflation data, she didn’t rule out future rate increases if inflation remains high, particularly in services. Despite persistent worries about elevated inflation forecasts, the RBA reaffirmed its commitment to current monetary policy. Updated projections suggest inflation reaching 3.8% by December, with the interest rate expected to remain unchanged until mid-2025. This stance is anticipated to provide eventual support for the Australian dollar, especially considering other major central banks’ considerations of interest rate cuts.