Shopping cart

Your cart empty!

The Federal Reserve's monetary policy announcement on Wednesday is expected to be uneventful. Most experts believe the Fed, under Chair Jerome Powell, will choose to leave interest rates exactly where they are, between 5.25% and 5.50%. This would be the fifth meeting in a row with no change. Analysts also widely predict the Fed will continue its plan to gradually sell off its bond holdings, a strategy known as quantitative tightening.

While there may not be any surprises regarding interest rates, everyone will be paying close attention to what the Fed says about the future. The Federal Open Market Committee (FOMC) might reiterate that it won't lower borrowing costs until it's much more confident that inflation is steadily dropping towards its target of 2%. In other words, the Fed wants to see clearer signs of inflation going down before it even considers easing up on interest rates.

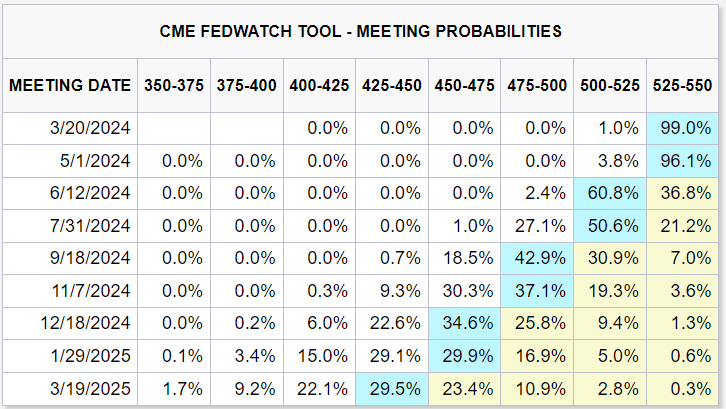

Current FOMC meeting probabilities. Source: CME Group

The Fed's economic forecasts are likely to show a stronger economy and more persistent inflation than previously anticipated. This is based on recent inflation reports (CPI and PPI) that continue to show price increases that are not coming down easily. This new outlook might lead the Fed to hint at a slower pace of easing restrictions in the coming months. In their projections (called the dot plot), they might indicate only two rate cuts in 2024 instead of the three previously expected.

If the Fed signals that they're going to be more cautious about lowering interest rates, this could have a big impact on financial markets. Interest rates on U.S. government bonds (Treasuries) and the value of the U.S. dollar could both rise further, continuing their recent upward trends. On the other hand, stocks and gold prices could see a sharp decline (correction) after their recent gains. This is because those gains were largely based on the expectation that the Fed would loosen its grip on the economy sooner rather than later.

Source: https://www.dailyfx.com/