Shopping cart

Your cart empty!

The U.S. dollar remained steady in early trading on Tuesday as investors assessed market movements following the Reserve Bank of Australia’s (RBA) latest policy decision. The Australian central bank implemented a widely anticipated rate cut but signaled a cautious approach to further easing. Policymakers emphasized that while another cut in April is not guaranteed, they are prepared to act should inflation continue to cool.

Following the announcement, the Australian dollar showed mixed performance. The AUD/USD pair held firm at 0.6355, recovering from an earlier low of 0.6335. Meanwhile, AUD/NZD saw stronger gains, climbing from 1.1100 to 1.1140, erasing losses from the previous two trading sessions.

Across broader forex markets, the greenback displayed a steadier tone as it attempted to recover from last week's declines. The EUR/USD and GBP/USD pairs each fell by 0.3%, trading at 1.0453 and 1.2595, respectively. Meanwhile, higher U.S. Treasury yields supported the USD/JPY pair, which rose 0.4% to trade just above 152.00. The 10-year U.S. Treasury yield climbed nearly 4 basis points, reaching 4.515% after Monday’s market break.

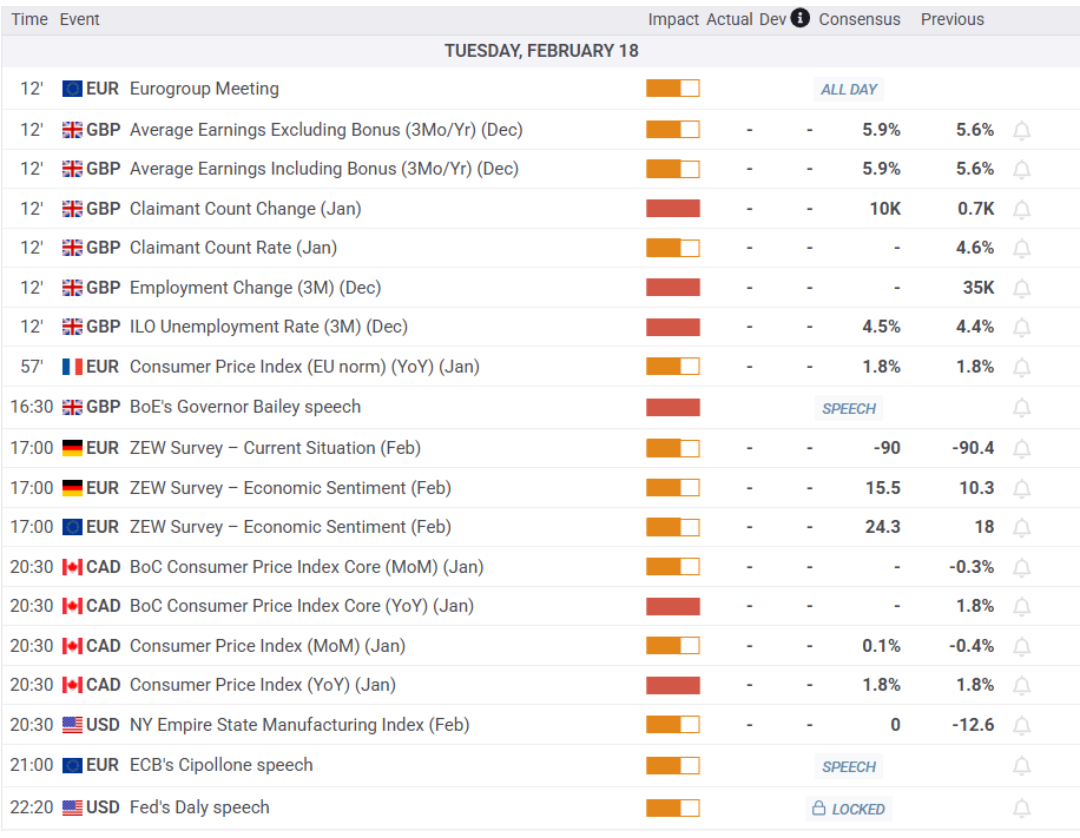

Upcoming Economic Calendar

Despite its current stability, the dollar remains under pressure after last week’s sell-off. Traders continue to unwind long dollar positions, reassessing the impact of U.S. political uncertainties. The greenback’s recent dominance in financial markets appears to be waning, with investors shifting focus to other asset classes, particularly technology stocks.

Technical indicators suggest a mixed outlook for the dollar. Key currency pairs such as EUR/USD, GBP/USD, and AUD/USD remain above their 100- and 200-hour moving averages, signaling near-term strength for these currencies. Conversely, USD/JPY, USD/CAD, and USD/CHF continue to trade below their respective moving averages, hinting at sustained dollar weakness.

Looking ahead, European trading hours will bring fresh economic data that could influence market sentiment. Key reports include the UK labor market data, final French inflation figures for January, and Germany’s ZEW business sentiment survey. These data points may provide further direction for the forex market as traders assess economic conditions and central bank policy signals.