Shopping cart

Your cart empty!

Your cart empty!

Join 10k+ people to get notified about new posts, news and tips.

Do not worry we don't spam!

We use cookies to ensure you get the best experience on our website. By continuing to use our site, you accept our use of cookies, Privacy Policy, and Terms of Service.

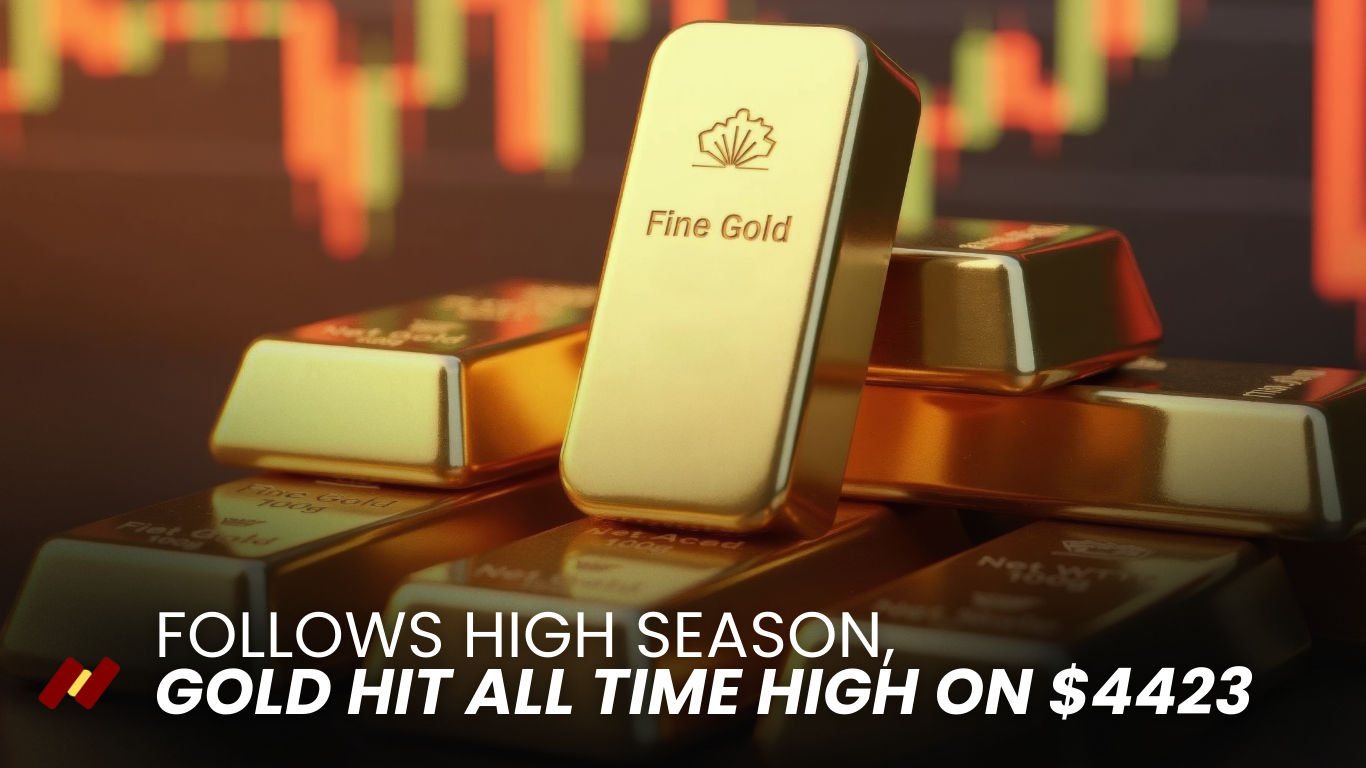

Gold and silver prices hit record highs in Asian trade on Monday as concerns over renewed hostilities between Iran and Israel, along with a brewing U.S.-Venezuela conflict, drove up demand for safe havens.

At 05:12 ET (10:12 GMT), Spot gold jumped 1.7% to a record high of $4,414.21 an ounce, surpassing its October peak, while gold futures for February rallied 1.4% to a peak of $4,447.85/oz.

Monday’s gains in metal markets are the latest in a long-running rally in the sector, as concerns over slowing global economic growth boosted demand for havens. Increased bets on more U.S. interest rate cuts in 2026 also aided demand for physical assets.

"Gold is driven by a range of structural and cyclical supports—including a Fed easing cycle, persistent central-bank demand, and elevated geopolitical and policy uncertainty. Even as some near-term drivers fade, gold continues to behave as a strategic portfolio allocation rather than a purely tactical hedge," OCBC analysts wrote in a note. They warned that silver could pull back on "signs of slowing industrial demand or growth concerns."

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s

Leave a Comment

You must be logged in to post a comment.