Shopping cart

Your cart empty!

Your cart empty!

Join 10k+ people to get notified about new posts, news and tips.

Do not worry we don't spam!

We use cookies to ensure you get the best experience on our website. By continuing to use our site, you accept our use of cookies, Privacy Policy, and Terms of Service.

The price of gold (XAU/USD) surged this week, reaching its highest level since December 2023. By the end of Friday, gold had gained a significant 2.33% for the week, settling near $2,082. This upward trend is likely due to a decrease in US Treasury yields. Investors were unsure about the Federal Reserve's next move after two important economic reports came out. The core PCE deflator, the Fed's preferred measure of inflation, met expectations at 0.4% for the month and 2.8% for the year. This relieved investors who were worried about even higher inflation after recent data showed strong price increases.

Recent data suggests the U.S. economy might be weakening. Disappointing manufacturing data indicates a potential slowdown, leading some to believe the Federal Reserve may loosen its monetary policy sooner than anticipated. This shift in expectations, reflected by a potential decline in interest rates, could significantly impact gold prices. If upcoming jobs data confirms economic strength, hopes of a policy shift will fade, potentially pushing gold prices down. However, a weaker jobs report could signal economic trouble, prompting investors to reassess interest rates and potentially boost the price of gold as a safe haven asset.

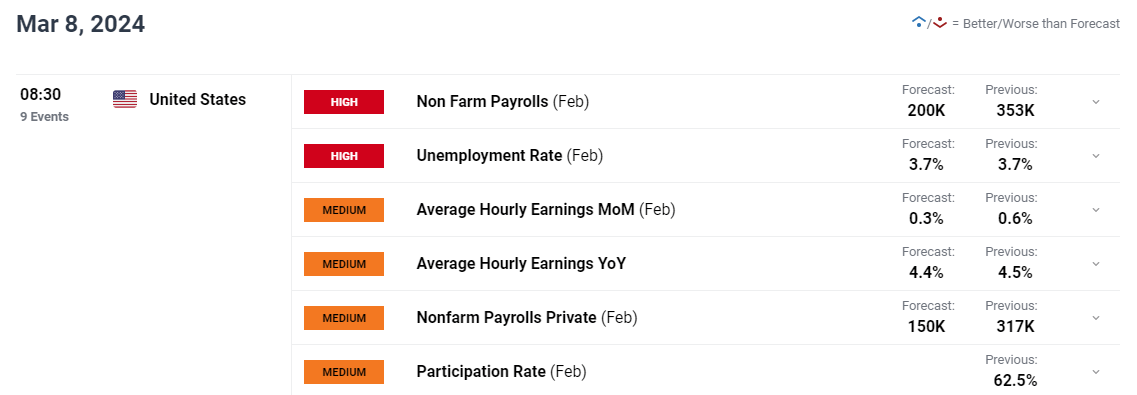

UPCOMING US JOBS REPORT

Source: https://www.dailyfx.com/

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s

Leave a Comment

You must be logged in to post a comment.