Shopping cart

Your cart empty!

Your cart empty!

Join 10k+ people to get notified about new posts, news and tips.

Do not worry we don't spam!

We use cookies to ensure you get the best experience on our website. By continuing to use our site, you accept our use of cookies, Privacy Policy, and Terms of Service.

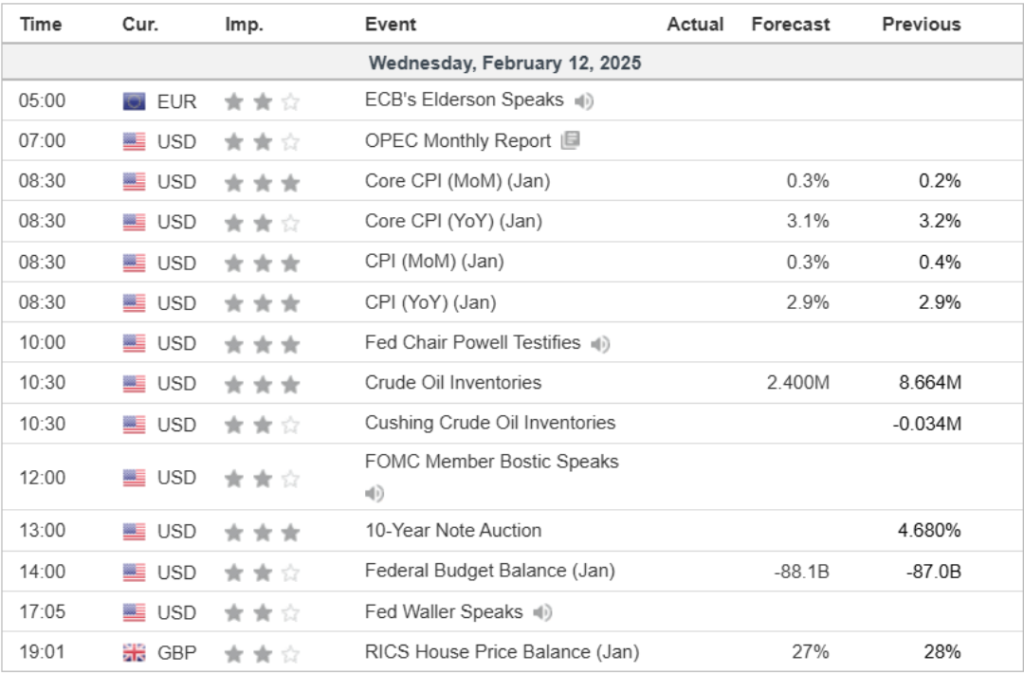

The U.S. Bureau of Labor Statistics is set to release the January Consumer Price Index (CPI) report on Wednesday at 13:30 GMT, with analysts anticipating stable inflation figures. The report is projected to show a 2.9% year-over-year increase in headline CPI, maintaining the same pace as the previous month.

Core CPI, which excludes volatile food and energy prices, is expected to remain above the Federal Reserve’s 2% target, coming in at 3.1% annually. Monthly forecasts suggest a 0.3% increase in both headline and core inflation. Analysts at TD Securities predict an acceleration in core CPI, citing seasonal price adjustments and stronger services inflation as key contributors.

Economic Calendar on 12/02/2025

Despite persistent inflation, investors are currently betting on a potential Federal Reserve interest rate cut in June. However, the Fed has maintained a cautious stance, with Chair Jerome Powell emphasizing that policy adjustments will depend on sustained progress toward the inflation target or signs of labor market weakness. Powell also noted that inflation trends remain uncertain, with external factors such as potential policy changes under former President Donald Trump adding to the unpredictability.

Market watchers will be closely monitoring the CPI report for any signals that could influence the Federal Reserve’s future policy decisions and the trajectory of the U.S. dollar.

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s

Leave a Comment

You must be logged in to post a comment.