Shopping cart

Your cart empty!

Your cart empty!

Join 10k+ people to get notified about new posts, news and tips.

Do not worry we don't spam!

We use cookies to ensure you get the best experience on our website. By continuing to use our site, you accept our use of cookies, Privacy Policy, and Terms of Service.

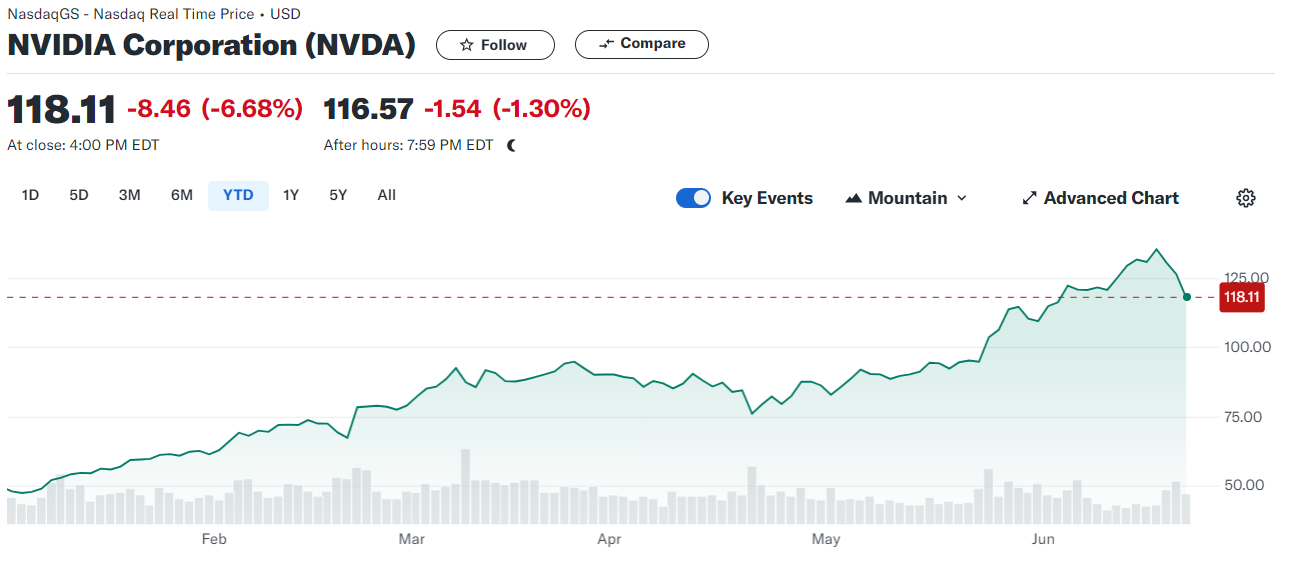

In a mixed start to the final week of a stellar quarter on Wall Street, US stocks diverged on Monday. Chip giant Nvidia's (NVDA) ongoing decline pulled the Nasdaq Composite (^IXIC) down more than 1%, while the S&P 500 (^GSPC) fell 0.3%. In contrast, the Dow Jones Industrial Average (^DJI) gained 0.7%, rising over 200 points as investors shifted their focus to the energy and financial sectors.

This quarter has been notable for significant gains, with the S&P 500 up over 4% and the Nasdaq surging around 7%, driven largely by an AI-fueled rally. However, this momentum shows signs of waning. Nvidia, a standout performer in 2024, has fallen more than 12% from its record high last week, underscoring this fatigue.

On the macroeconomic front, attention this week will pivot to the US political arena and key economic indicators. President Joe Biden and presumptive Republican nominee Donald Trump are scheduled for their first debate on Thursday evening, an event that could have implications for market sentiment. Additionally, the release of the Personal Consumption Expenditures (PCE) index on Friday morning will be closely watched, particularly the "core" PCE measure, which is a key indicator for the Federal Reserve.

Economists anticipate that the core PCE rose just 0.1% last month, marking the slowest monthly increase since November. Such a result would add to a series of positive economic data points, potentially alleviating Federal Reserve policymakers' concerns about the need for rate cuts this year. According to the CME FedWatch tool, traders are now expecting the Fed to begin reducing rates in September.

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s

Leave a Comment

You must be logged in to post a comment.