Shopping cart

Your cart empty!

Your cart empty!

Join 10k+ people to get notified about new posts, news and tips.

Do not worry we don't spam!

We use cookies to ensure you get the best experience on our website. By continuing to use our site, you accept our use of cookies, Privacy Policy, and Terms of Service.

The EUR/USD pair remains under pressure, declining toward the 1.0800 mark following a modest rebound spurred by German inflation data. A risk-averse sentiment in the market, highlighted by bearish trends on Wall Street, is bolstering the USD and negatively impacting the pair.

Early Wednesday trading saw the EUR/USD pair drop, finding intraday support at 1.0836. Comments from Federal Reserve officials have dampened expectations of a September interest rate cut, fueling risk aversion across financial markets. This sentiment led to declines in stock markets, with most Asian indexes falling into the red and European markets also edging lower, restraining the pair's rebound before the release of German inflation figures.

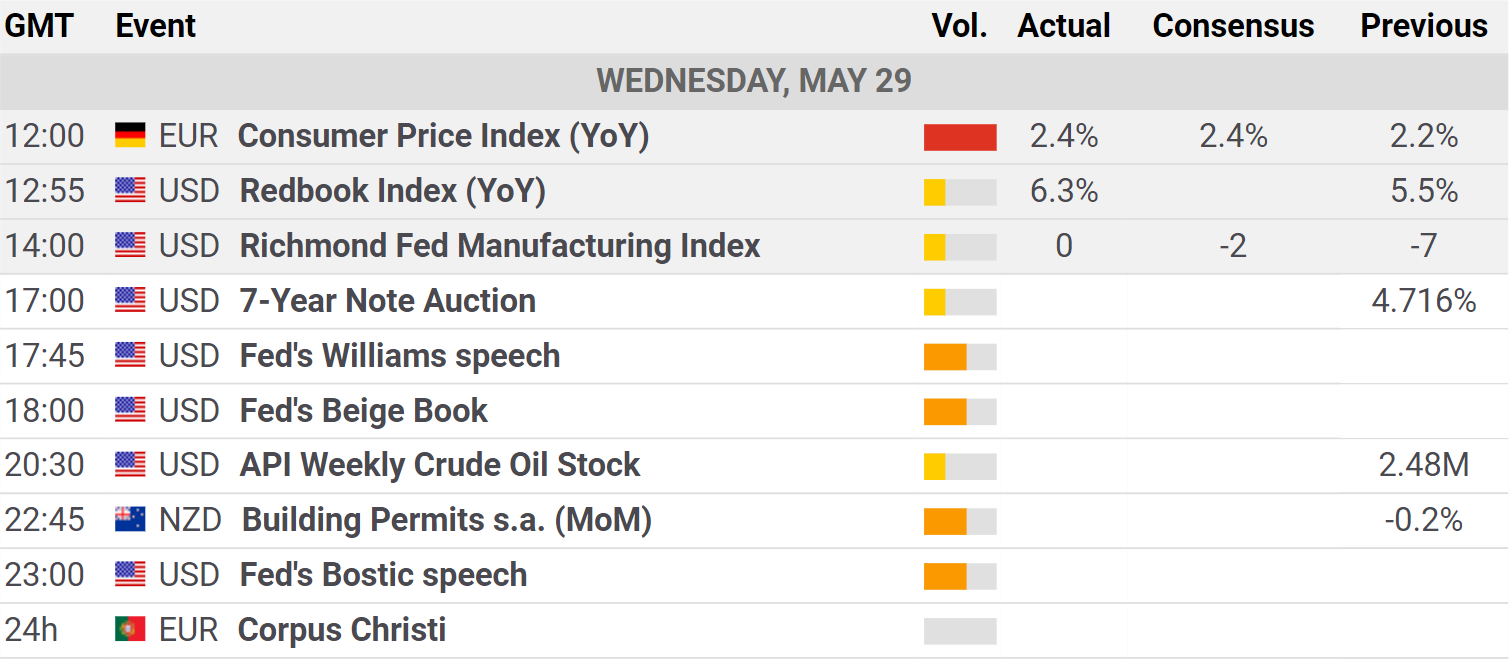

ECONOMIC CALENDAR 29 MAY, 2024 (fxstreet)

Preliminary estimates indicate that Germany's Harmonized Index of Consumer Prices (HICP) rose by 0.1% month-on-month in May, with an annual increase of 2.8%, surpassing expectations of 2.7% and the previous 2.4%, according to Destatis. While this news helped the EUR/USD pair recover somewhat, it remains around familiar levels near 1.0850.

The American trading session is expected to see the release of minor economic indicators from the United States, including the Richmond Fed Manufacturing Index for May and the Fed's Beige Book. Additionally, a public appearance by New York Fed President John Williams is on the agenda.

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s

Leave a Comment

You must be logged in to post a comment.