Shopping cart

Your cart empty!

Your cart empty!

Join 10k+ people to get notified about new posts, news and tips.

Do not worry we don't spam!

We use cookies to ensure you get the best experience on our website. By continuing to use our site, you accept our use of cookies, Privacy Policy, and Terms of Service.

Gold (XAUUSD) prices rose on Friday despite a slight recovery in the US Dollar. Analysts attribute this increase to expectations that a weakening labor market could lead the Federal Reserve to consider cutting interest rates earlier than anticipated, aiming to boost economic growth. Additionally, concerns over geopolitical tensions are bolstering the appeal of gold to investors.

Nevertheless, the prospect of hawkish discussions on interest rates by the US Federal Reserve and a strengthening US Dollar may dampen the enthusiasm for gold. Traders are closely monitoring the upcoming release of the US Michigan Consumer Sentiment Index for May, as well as speeches from Fed officials Bowman, Goolsbee, and Barr. Attention will also turn to next week's US Consumer Price Index (CPI) report.

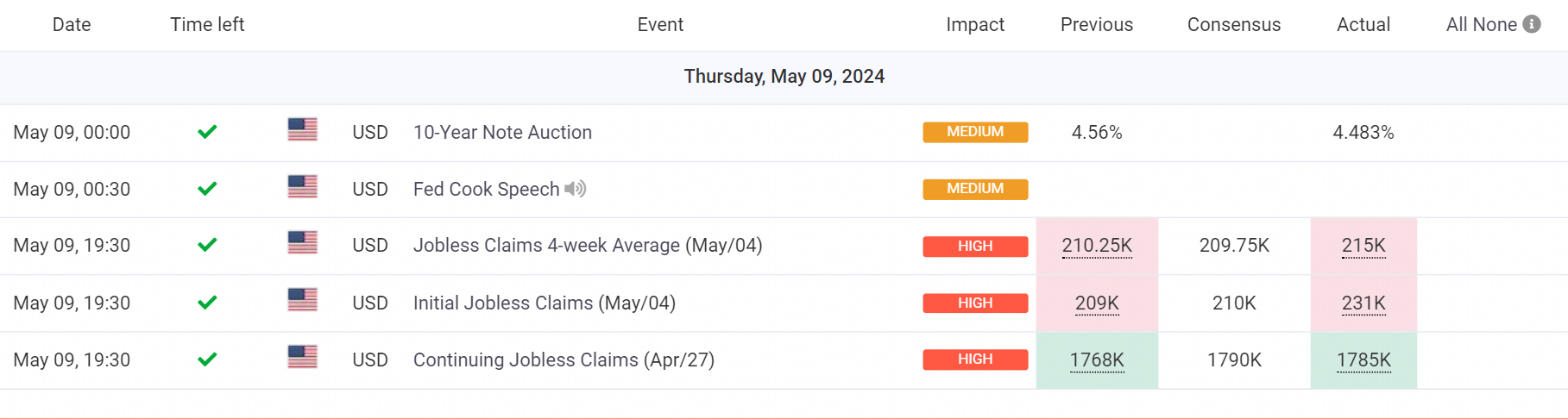

US Economic Calendar On 09th May 2024

(Source: myfxbook)

If gold buyers jump in at the crucial $2,400 level, gold could surge to a record price near $2,432, on its way to the $2,500 mark. On the other hand, the first potential drop could happen at the previous hurdle that became a safety net level at $2,340. If gold keeps dropping, it could fall as low as $2,300, followed by a low of May 2 at $2,281.

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s

Leave a Comment

You must be logged in to post a comment.