Shopping cart

Your cart empty!

Your cart empty!

Join 10k+ people to get notified about new posts, news and tips.

Do not worry we don't spam!

We use cookies to ensure you get the best experience on our website. By continuing to use our site, you accept our use of cookies, Privacy Policy, and Terms of Service.

Bank of England (BoE) Monetary Policy Committee member Catherine Mann, who was among the four policymakers who voted against raising interest rates at the last central bank meeting, has cautioned that inflation could see a resurgence in the coming months. In an interview with the Financial Times, Mann pointed to recent surveys indicating a persistent upward trend in both wage and price-setting processes. She suggested that this trend might be structural, having been entrenched during the period of elevated inflation over the past few years. Mann noted that this inflationary pressure could take a considerable amount of time to diminish.

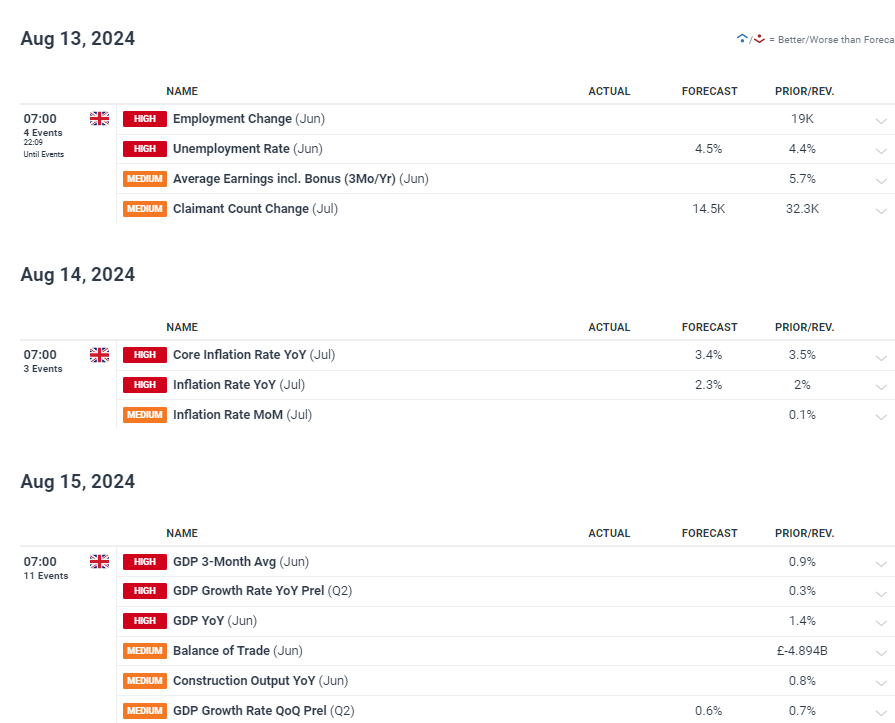

Mann's comments come as the UK prepares for a wave of significant economic data releases, including updates on employment, wages, inflation, and GDP, all scheduled for the coming days.

Economic Calendar for UK (Dailyfx)

Meanwhile, in the forex market, the GBP/USD currency pair reached a multi-week low of 1.2665 last week, driven by a weaker pound and a stronger U.S. dollar. However, the pair has since recovered slightly, trading around 1.2770, supported by the 200-day simple moving average. As the pair attempts to break out of a sharp one-month downtrend—after hitting a 13-month high of 1.3045 on July 17—this week's economic data is expected to play a crucial role in determining its direction. Key support remains at 1.2665, with near-term resistance around 1.2863.

Dialy Chart GBPUSD: Published by Tradingview

Retail trader sentiment shows that 51.94% of traders are net-long on GBP/USD, with a slight increase in net-long positions compared to the previous day and week. Given this sentiment, analysts maintain a bearish outlook for the currency pair, suggesting that GBP/USD may continue to decline.

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s

Leave a Comment

You must be logged in to post a comment.