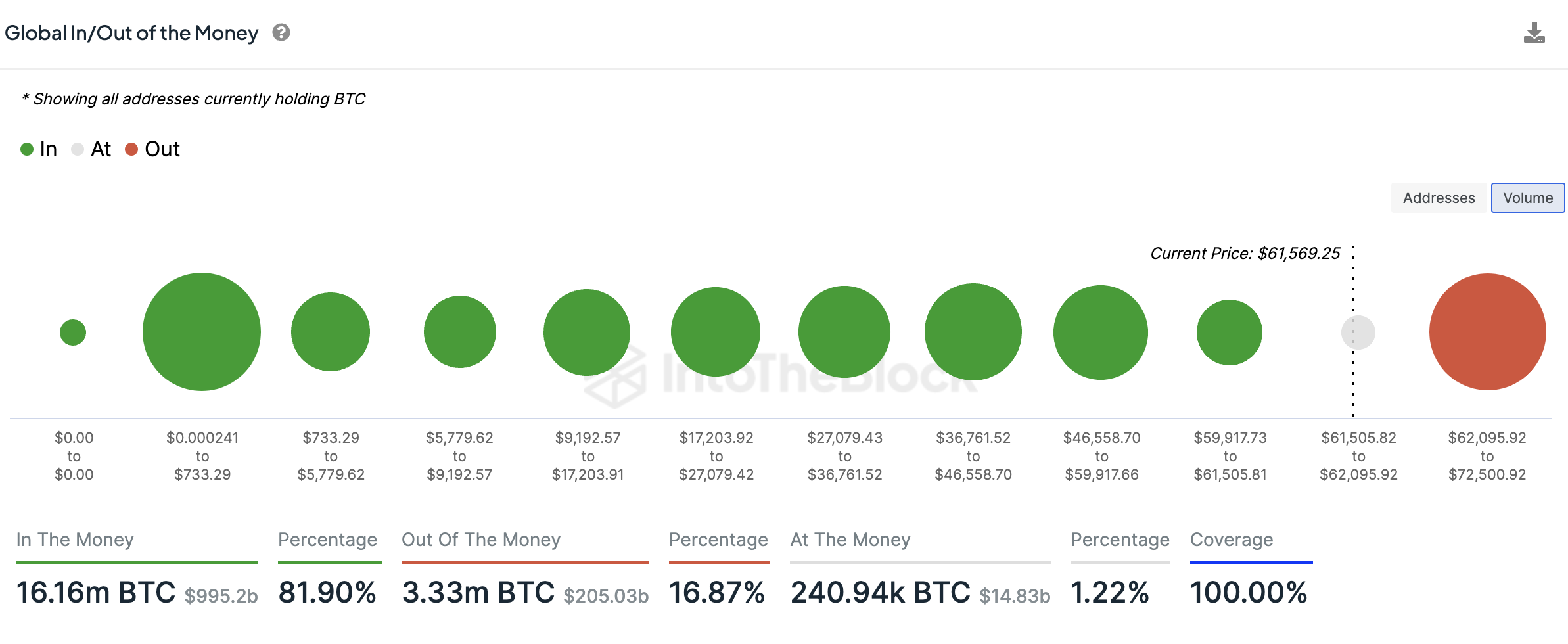

June 30 – Data from Glassnode reveals that Bitcoin (BTC) wallet addresses holding at least one Bitcoin have surpassed the 1 million mark. This milestone indicates growing confidence among retail investors, with the majority of BTC holders currently profitable at the present price. Analysts are optimistic about a potential bull run in Bitcoin, the largest cryptocurrency by market capitalization.

Meanwhile, Ethereum (ETH) and Polygon (MATIC) are dominating the institutional investment landscape within the cryptocurrency sector. The second-largest crypto ecosystem, Ethereum, and the scaling protocol, Polygon, have both experienced increased institutional interest following the launch of new crypto-related products. This influx of investment is expected to enhance the utility of tokens within these networks, thereby benefiting traders and the broader crypto market.

However, not all cryptocurrencies are faring well. Several Layer 1 tokens, including Tezos (XTZ), IOTA (IOTA), Klaytn (KLAY), Algorand (ALGO), and EOS (EOS), are struggling to recover this cycle. The cryptocurrency market’s cyclical nature has led to significant price declines for these tokens, with drawdowns exceeding 75%. New trends, such as the rise of Artificial Intelligence (AI) and meme coins, are overshadowing these older Layer 1 tokens, potentially marking them as “dead coins“ in the current market environment.