Shopping cart

Your cart empty!

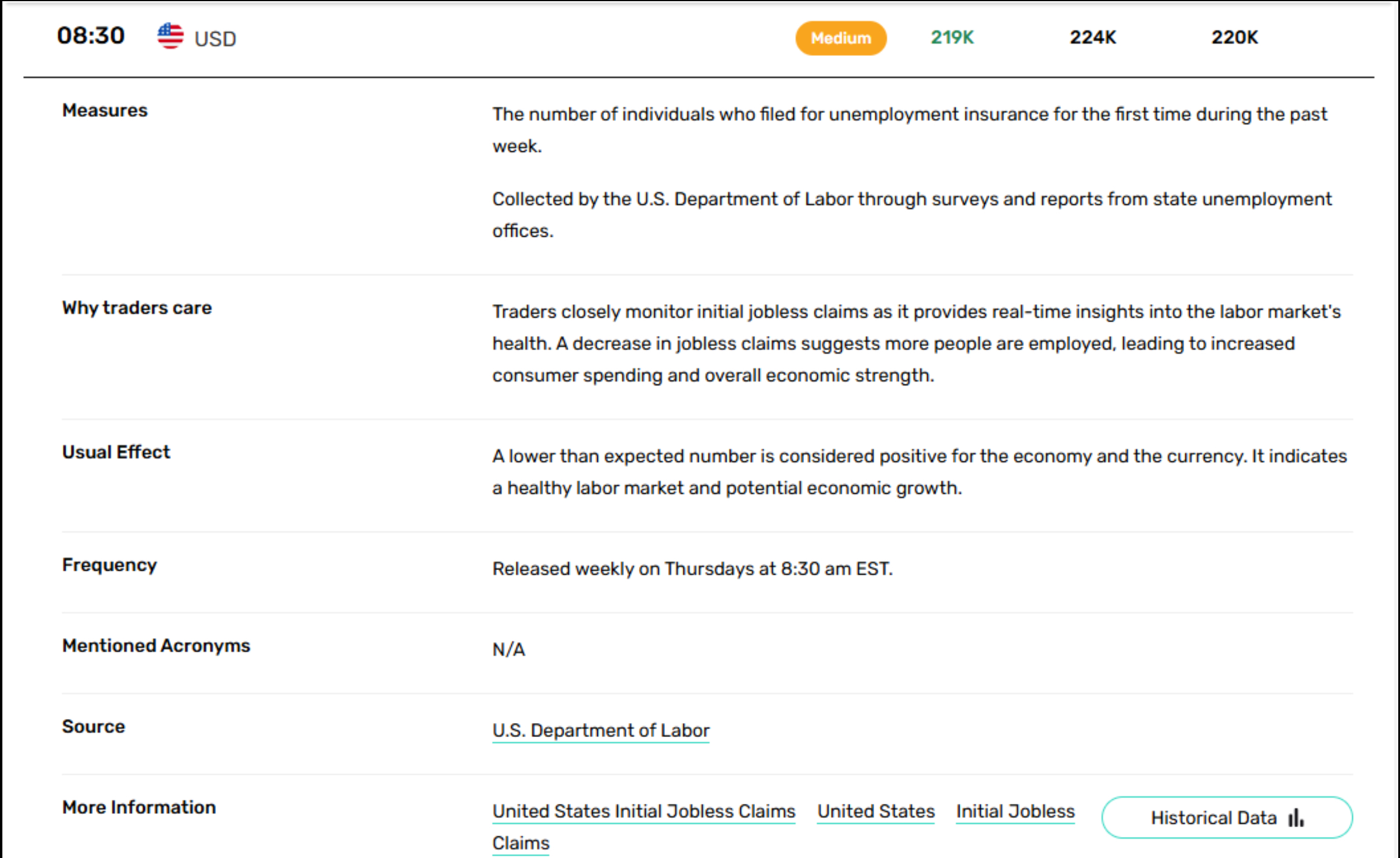

New data from the U.S. Department of Labor paints a complex picture of the nation’s labor market. While initial jobless claims decreased slightly last week, a sharp rise in insured unemployment suggests deeper challenges may be looming.

Seasonally adjusted initial claims for unemployment benefits fell by 1,000 to 219,000 for the week ending December 21, signaling relative stability in layoffs. However, the insured unemployment rate—which tracks the percentage of workers receiving continued benefits—rose to 1.3%, its highest level in over three years. The number of insured unemployed jumped by 46,000 to reach 1.91 million, reflecting a growing pool of jobseekers struggling to find new positions.

Unadjusted claims rose by 9% to 274,734, consistent with seasonal patterns, but still point to slight softening in the labor market compared to previous weeks. US Unemployment Data

The dip in initial claims indicates that companies are largely avoiding large-scale layoffs, a positive sign for near-term labor market health. However, the rising trend in insured unemployment suggests challenges for those already displaced, potentially signaling a slowdown in hiring or extended job search periods.

This divergence presents risks for economic growth. Prolonged unemployment often curtails consumer spending, which could weigh on sectors like retail, hospitality, and other discretionary industries.

Financial markets are likely to interpret the data cautiously. While stable layoffs could bolster investor confidence in some sectors, the increase in insured unemployment may dampen sentiment in labor-reliant industries. Volatility may persist in equity markets as traders evaluate the implications for corporate earnings and consumer demand.

As the labor market faces competing forces of resilience and strain, upcoming economic reports will be critical in shaping expectations for 2025. For now, the data highlights a labor market that is holding steady in some areas but showing signs of potential stress in others.