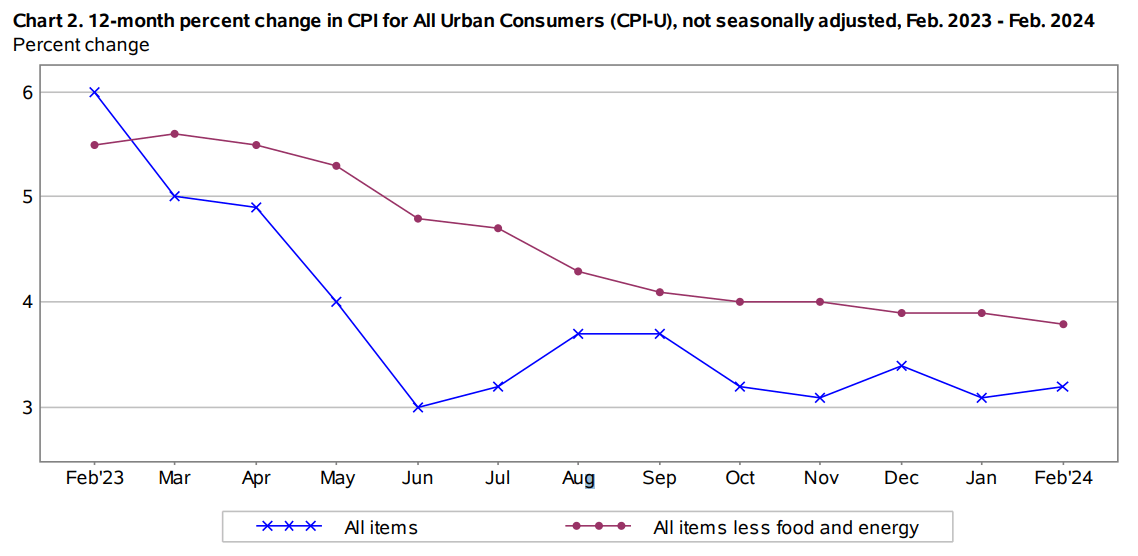

The U.S. economy is facing challenges in bringing down inflation rates. As a result, there’s a lot of attention on the Consumer Price Index (CPI) numbers for March, which will be released on Wednesday by the U.S. Bureau of Labor Statistics. This report is significant because it could cause major fluctuations in the value of investments (assets) across different markets. Traders, particularly, should be prepared for potentially risky market conditions, especially if the inflation data comes in higher than expected.

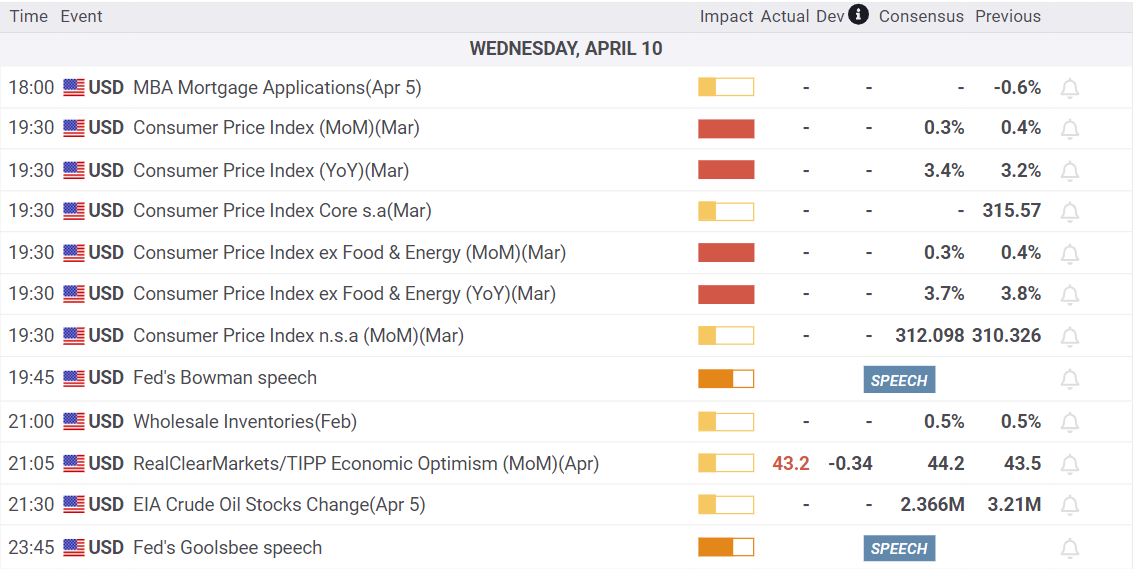

Analysts predict a monthly increase of 0.3% in headline CPI, which would also push the yearly inflation rate up to 3.4% from the previous reading of 3.2%. The core CPI, which excludes food and energy prices, is also expected to rise by 0.3% when adjusted for seasonal factors. While the annual core inflation rate is projected to decrease slightly to 3.7% from 3.8%, this change would be small.

Source: BLS

Upcoming Economic Calendar

Source: fxstreet

SCENARIOS TO EXPECT

The CPI report surpasses expectations, indicating a potential resurgence in inflation. This challenges the belief that earlier price increases were temporary and suggests a prolonged struggle to stabilize prices. Consequently, there’s speculation that the Fed may delay its easing cycle as it reassesses its policy stance. While this could benefit the U.S. dollar, it may negatively affect riskier assets like equities.

Inflation figures fall short of predictions, likely sparking market enthusiasm, especially if the deviation from expectations is significant. This could lead traders to anticipate rate cuts by the Fed starting in June, possibly aligning with the central bank’s earlier projections. Anticipation of a dovish shift in monetary policy may suppress Treasury yields, weaken the U.S. dollar, and lift risk assets.