Shopping cart

Your cart empty!

In today's European trading session, the EUR/USD pair maintains a sideways trajectory, hovering around the 1.0850 mark. This movement comes amidst a dearth of fresh fundamental triggers and subdued market activity due to holiday-induced thin trading conditions.

The Dollar's upturn was fueled by robust preliminary US PMI data for May, along with a strong performance in US bond yields across various maturities. Speculation intensified that the Federal Reserve (Fed) might prolong its hawkish stance, supported by a cautious tone from Fed officials, the sturdy state of the US economy, persistent inflation, and a tight labor market.

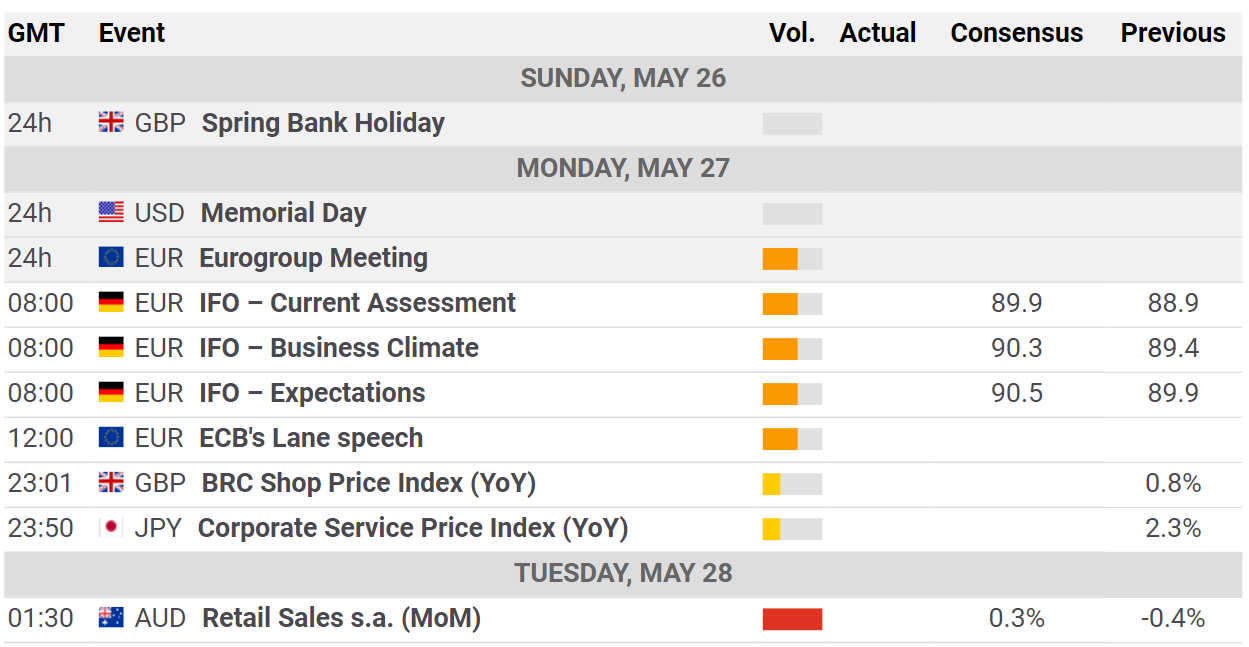

ECONOMIC CALENDAR (myfxbook)

The Fed's inclination towards maintaining its current tight stance was underscored by the discussion highlighted in the FOMC Minutes from the May 1 meeting, emphasizing the necessity of "sufficiently" restrictive policy to combat inflation amid strong economic indicators.

This monetary policy divergence between the Fed and other G10 central banks, notably the European Central Bank (ECB), became more pronounced, especially as expectations of an ECB rate cut diminished following an increase in the ECB’s Negotiated Wage Growth.

Looking ahead, the relatively lackluster economic fundamentals in the Eurozone, juxtaposed with the resilience of the US economy, reinforce the narrative of Fed-ECB policy divergence, favoring a stronger Dollar over the long term. This scenario heightens the potential for further weakness in EUR/USD in the medium term.