Pnhom Penh – November 28, 2025 – Global financial trading has been heavily disrupted on this post-Thanksgiving Black Friday, as CME Group, the world’s leading derivatives marketplace, was forced to halt the majority of its electronic trading platforms. The widespread outage is attributed to a critical technical malfunction at one of the exchange’s core data center facilities.

The suspension, which began in the early hours of Friday morning (CT), affects the critical Globex electronic trading platform, which underpins the vast majority of CME’s transaction volumes worldwide.

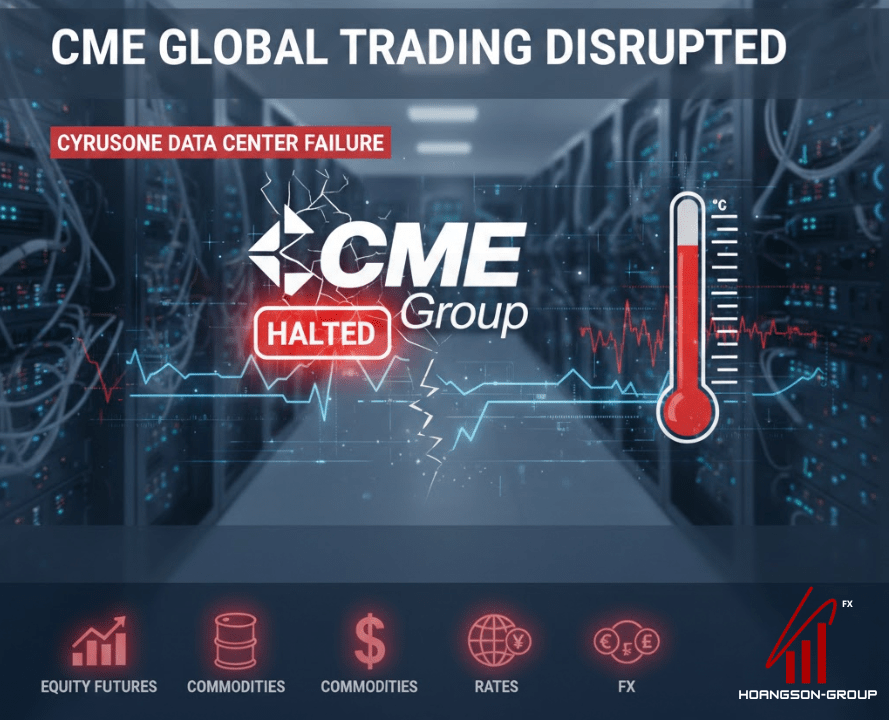

CME Group Global Trading Halted by Massive Data Center Cooling Failure

CHICAGO/LONDON/SINGAPORE – November 28, 2025 – Global financial trading has been heavily disrupted on this post-Thanksgiving Black Friday, as CME Group, the world’s leading derivatives marketplace, was forced to halt the majority of its electronic trading platforms. The widespread outage is attributed to a critical technical malfunction at one of the exchange’s core data center facilities.

The suspension, which began in the early hours of Friday morning (CT), affects the critical Globex electronic trading platform, which underpins the vast majority of CME’s transaction volumes worldwide.

-

Temperature Spikes: Server temperatures can exceed safe operating thresholds within minutes.

-

Risk of Catastrophe: To prevent irreversible damage to sensitive hardware and catastrophic loss of trillions of dollars worth of market data, facility operators are compelled to execute an emergency shutdown.

-

Diagnosis: CME and CyrusOne officials have reiterated that this is an infrastructure/facility failure and not the result of a malicious cyberattack.

Widespread Market Impact

The trading halt has frozen price discovery across some of the world’s most liquid contracts, leading to uncertainty as markets attempt to navigate a holiday-thinned trading day. The affected markets include:

Asset Class Key Contracts Affected (Examples) Equity Futures S&P 500, Nasdaq 100, Dow Jones Industrial Average futures Commodities WTI Crude Oil, Gold, Palm Oil, and various agricultural contracts Interest Rates (Rates) U.S. Treasury futures (e.g., 10-Year T-Note) Foreign Exchange (FX) Price updates on the EBS foreign-exchange platform (major currency pairs) Cryptocurrency Bitcoin, Ethereum, and Solana futures contracts Current Status and Outlook

As of the latest updates on Friday, November 28, 2025, CME Group reports that its technical teams, alongside specialized contractors from CyrusOne, are actively working to restore full cooling capacity.

-

Partial Restoration: The BrokerTec US Actives and BrokerTec EU markets have been successfully reopened for trading.

-

Ongoing Halt: The core CME Globex Futures & Options markets, EBS, and BMD remain suspended.

-

Resolution Efforts: CyrusOne confirmed they have managed to restart several chillers at limited capacity and have deployed temporary cooling equipment to supplement permanent systems.

CME Group has not yet provided a precise timeline for the full reopening of the Globex platform, advising clients that they will be notified of “Pre-Open details” as soon as they become available.

-

The Root Cause: Infrastructure Failure

CME Group confirmed that the immediate cause of the disruption is a significant cooling issue at the CyrusOne data center located in the Chicago area (Aurora, Illinois), which houses the matching engines for all Globex products.

A spokesperson for CyrusOne detailed that the glitch originated from a chiller plant failure affecting multiple cooling units. This failure resulted in a rapid, uncontrolled rise in the server environment’s temperature.

Why Cooling is Critical: Modern data centers, like the one used by CME, contain thousands of powerful servers that generate immense heat. If the cooling system fails: