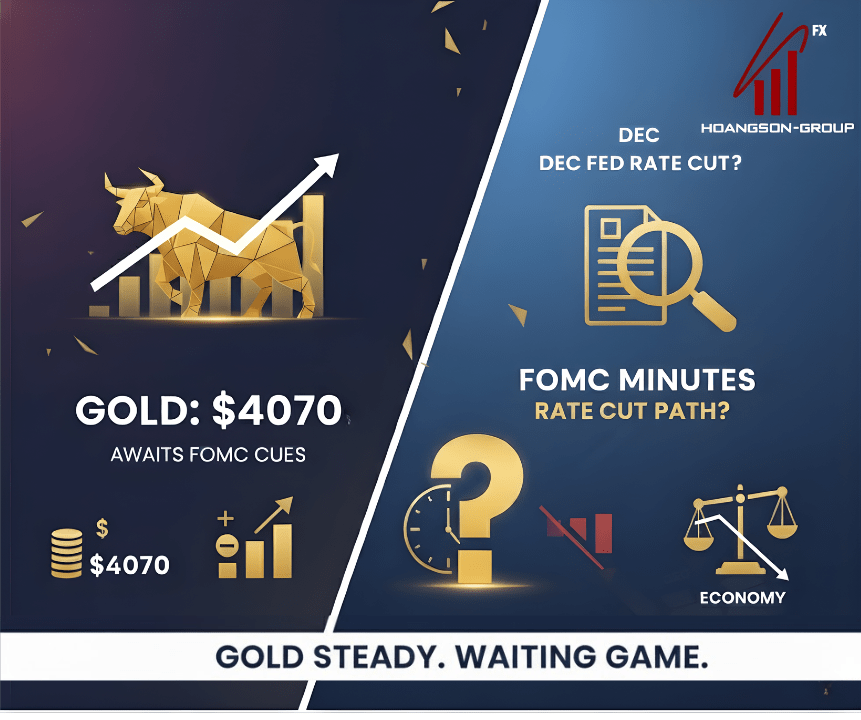

Gold prices remained stable near the $4,070 mark on Wednesday, displaying resilience amid subdued US Dollar activity and a revival of safe-haven interest. The precious metal, which had earlier bounced back from a one-and-a-half-week low just under $4,000, is currently finding support from broader economic and geopolitical concerns.

Key Market Dynamics

-

Safe-Haven Demand Rises: The fragile risk sentiment in the market, evidenced by an overnight slump on Wall Street and ongoing concerns about the US economy, is bolstering gold’s appeal as a safe-haven asset. Furthermore, geopolitical risks associated with the Russia-Ukraine conflict continue to lend support to the metal.

-

Subdued US Dollar (USD): The USD is trading defensively through the Asian session, primarily due to the prevailing risk-off mood, which is favorable for gold, a metal priced in the US currency.

-

Fed Rate Bets Cap Gains: Despite the support, significant appreciation for gold is being limited by reduced expectations for a December interest rate cut by the US Federal Reserve (Fed). Higher-for-longer rate expectations boost the US Dollar and weigh on the non-yielding metal.

Focus Shifts to FOMC Minutes

Market participants appear reluctant to commit to a strong directional move before receiving fresh clues on the Fed’s monetary policy path. The immediate market focus is now squarely on the release of the FOMC minutes later this Wednesday.

This document is expected to provide deeper insights into the central bank’s stance on future rate adjustments. Following the minutes, traders will also key in on the delayed US Nonfarm Payrolls (NFP) report on Thursday, looking for further evidence of a potentially softening labor market that could influence the Fed’s decisions.