February 5, 2025 – Gold prices continue their upward momentum, reaching an all-time high of approximately $2,854 during the Asian trading session on Wednesday. The precious metal’s surge comes amid escalating concerns over renewed trade tensions between the United States and China, reinforcing its status as a preferred safe-haven asset.

Market sentiment remains cautious as investors react to China’s latest retaliatory tariffs against U.S. imports. The move follows U.S. President Donald Trump’s decision to impose new duties on Chinese goods, stoking fears of an intensified trade war between the world’s two largest economies. This uncertainty has fueled demand for gold, which traditionally benefits from periods of geopolitical and economic instability.

Additionally, recent U.S. labor market data points to weakening economic conditions. The Job Openings and Labor Turnover Survey (JOLTS) released on Tuesday revealed a decline in job openings to 7.6 million in December, down from 8.09 million the previous month. The slowdown in employment figures raises expectations that the Federal Reserve may maintain its monetary easing stance, further weighing on the U.S. dollar and boosting gold prices.

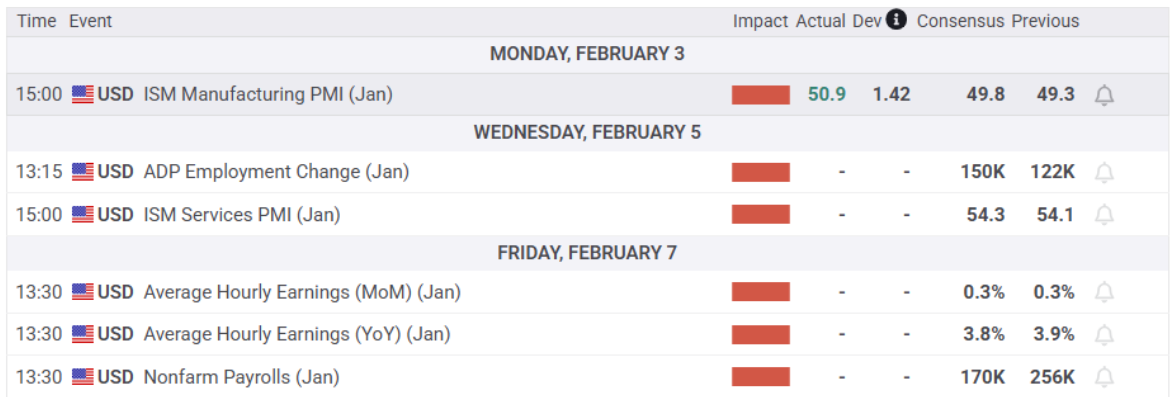

Economic Calendar Data This Week

The greenback remains near its weekly low, providing additional tailwinds for gold. However, despite bullish market sentiment, technical indicators suggest caution, as the metal appears slightly overbought on daily charts. Investors are closely watching upcoming U.S. economic data, including the ADP private-sector employment report and the ISM Services PMI, which could impact short-term price movements.

In a separate development, President Trump announced a 30-day delay in the implementation of 25% trade tariffs on Canada and Mexico, raising hopes that broader trade conflicts could be mitigated. Despite this, gold prices remain resilient, with investors continuing to favor the metal as a hedge against ongoing economic uncertainties.

Looking ahead, market participants await the U.S. Nonfarm Payrolls (NFP) report due on Friday, which is expected to provide further insights into labor market trends and influence the Federal Reserve’s policy outlook. Meanwhile, developments on trade negotiations and tariff policies are likely to drive market volatility in the coming days.