The GBP/USD pair experienced a slight decline on Wednesday, briefly falling below the 1.2650 level following disappointing economic data from the UK. However, the pair showed resilience, rebounding to trade modestly higher above 1.2750 on Thursday. Technical indicators suggest that the bullish momentum could remain intact in the near term.

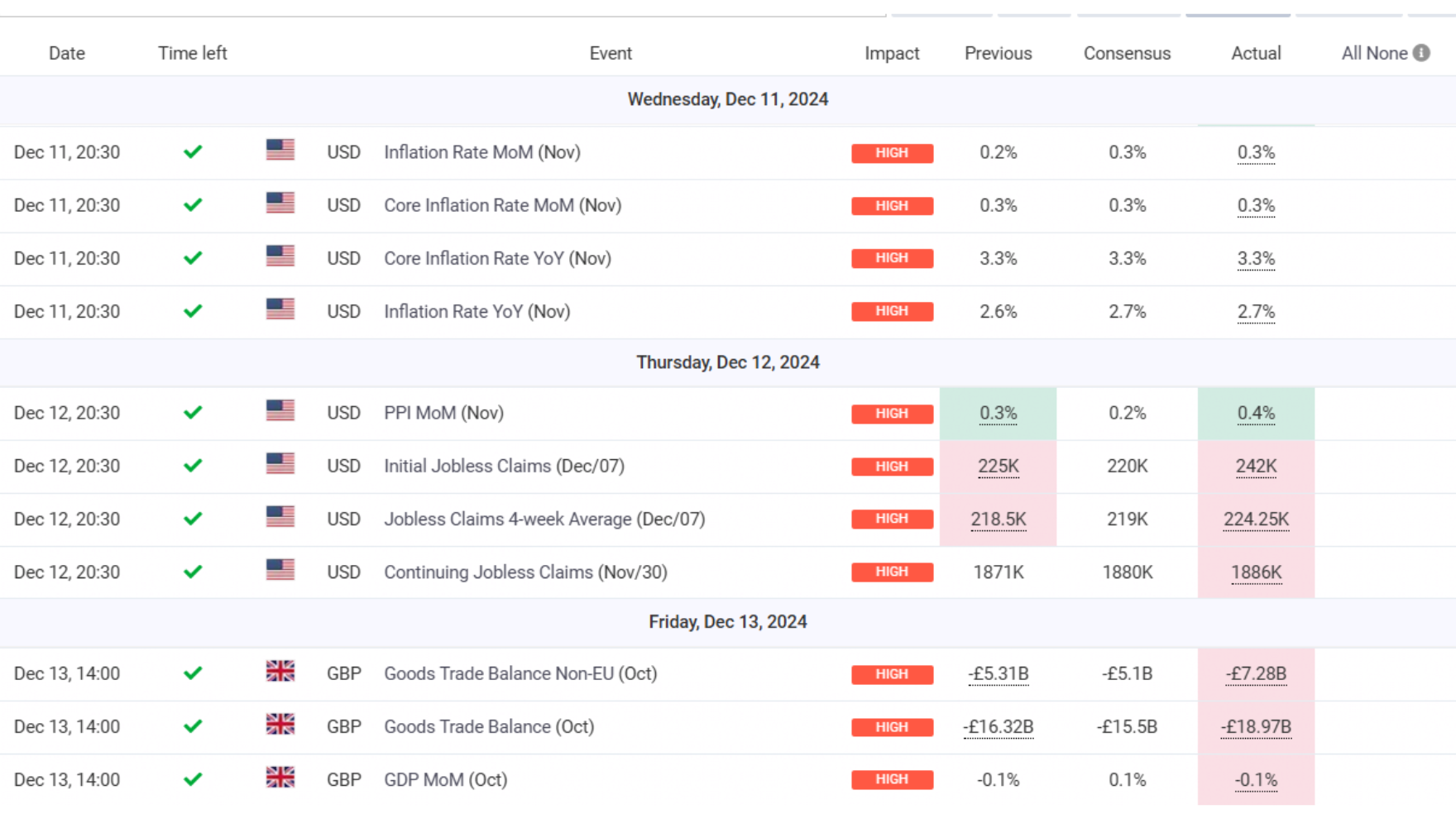

The US Dollar gained strength midweek, supported by solid inflation figures. The Bureau of Labor Statistics (BLS) reported that both the Consumer Price Index (CPI) and the core CPI rose by 0.3% month-on-month, in line with market expectations.

Economic Calendar This Week

Market participants are now turning their attention to critical US economic releases later in the day, including the Producer Price Index (PPI) for November and the Initial Jobless Claims report. Analysts forecast a decline in first-time jobless claims to 220,000 from the previous week’s 224,000. However, if claims surpass 230,000, the US Dollar could face selling pressure, potentially driving GBP/USD higher.

Meanwhile, US stock index futures showed losses between 0.2% and 0.3%, indicating a bearish Wall Street opening that might cap GBP/USD’s upside during the early American session.

Investors are also keeping a close watch on the European Central Bank (ECB) policy announcements. A dovish surprise—such as a 50-basis-point rate cut or a 25-basis-point cut accompanied by softer policy guidance—could weaken the Euro. In such a scenario, the Pound Sterling might benefit from capital outflows from the Eurozone, helping it stay resilient against the US Dollar.