In Wednesday’s European session, the Pound Sterling (GBP) surged to 1.2750 as per the data released by the UK Office for National Statistics (ONS), indicating a slower decline in the Consumer Price Index (CPI) for April than anticipated. Despite remaining higher than expected, UK inflationary pressures have eased notably from March levels, largely attributed to the Bank of England’s (BoE) efforts to curb inflation through potential interest rate hikes.

The less-than-expected decrease in UK inflation is likely to dampen expectations for BoE’s plans to cut interest rates, a move anticipated by financial markets to commence from the August meeting. Speculation regarding BoE’s intention to lower borrowing costs gained traction following comments made by BoE Deputy Governor Ben Broadbent earlier in the week. Broadbent hinted at the possibility of a rate cut during the summer, stating, “If things continue to evolve with its forecasts – forecasts that suggest policy will have to become less restrictive at some point – then it’s possible Bank Rate could be cut sometime over the summer,” as reported by Reuters.

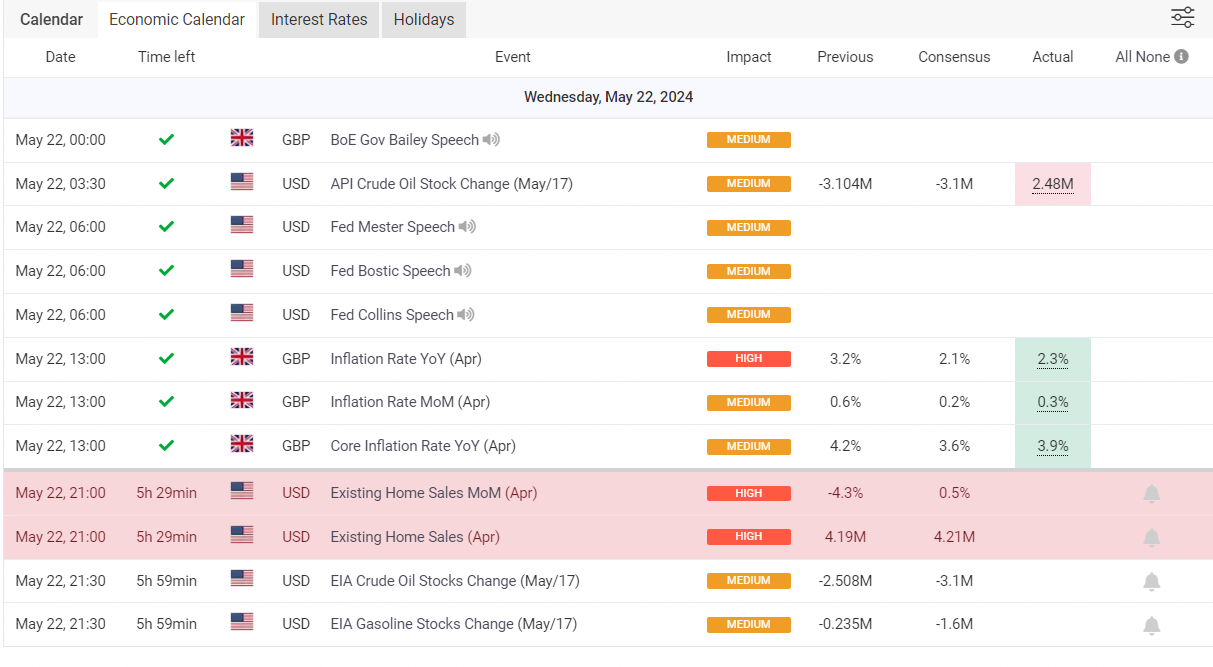

ECONOMIC CALENDAR MAY 22, 2024 (MYFXBOOK)

Encouraging inflation data for April from the UK propelled the Pound Sterling (GBP) to 1.2750. Headline inflation rose 2.3% YoY, surpassing expectations but moderating from the previous month’s 3.3%. Monthly inflation also exceeded estimates, growing by 0.3%. Meanwhile, the UK’s core CPI expanded by 3.9% YoY, higher than consensus but slower than March’s 4.2%, influencing Bank of England’s (BoE) interest rate decisions amidst lingering inflationary pressures.

In the US, the Federal Reserve (Fed) remains cautious about interest rate adjustments, waiting for sustained evidence of inflation decline towards the 2% target. Despite signs of progress after a slowdown earlier this year, policymakers like Cleveland Fed Bank President Loretta Mester advocate for further inflation declines before considering rate cuts. This cautious stance has kept the US Dollar (USD) in a sideways trend, amid speculation about potential rate cuts from the September meeting.

Attention now shifts to the Federal Open Market Committee (FOMC) minutes from the May meeting for insights into the Fed’s interest rate outlook. Investors are closely monitoring developments amidst nuanced inflationary dynamics and central bank deliberations, seeking cues for currency valuations and future monetary policy trajectories.