The US dollar weakened on Wednesday, May 15th, with the US Dollar Index (DXY) trading near 104.4. This decline comes after softer-than-expected economic data, including lower Consumer Price Index (CPI) and flat Retail Sales figures for April, pointed to a potential slowdown in the US economy.

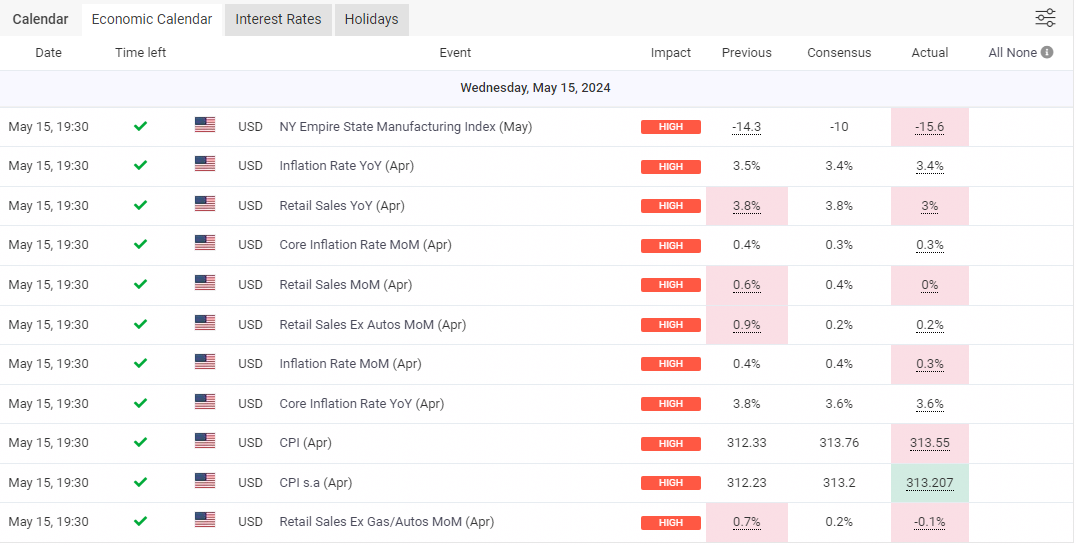

ECONOMIC CALENDAR ON MAY 15 2024 (by myfxbook)

The US Bureau of Labor Statistics released economic data today revealing a mixed bag. Inflation, as measured by the Consumer Price Index (CPI), dipped slightly to 3.4% year-over-year (YoY) in April, down from 3.5% the prior month and meeting market expectations. Core CPI, excluding volatile food and energy prices, followed a similar trend, dropping to 3.6% YoY from March’s 3.8%, again in line with forecasts. However, both CPI and core CPI ticked up 0.3% month-over-month (MoM) during the same period.

While the easing inflation is a welcome sign, it’s overshadowed by the stagnant retail sales figures. US retail sales showed no growth in April, falling short of the anticipated 0.4% MoM increase and marking a decline from the 0.6% MoM reported in March. This downturn in consumer spending could signal potential trouble for the US economy.

The Federal Reserve will likely be closely monitoring this data as they consider future interest rate adjustments. The CME FedWatch tool suggests the Fed is highly likely to hold rates steady in June, with a slight increase in the odds of a cut in July. However, September’s FOMC meeting currently holds the highest probability of a rate cut by the Fed.