Gold prices staged a comeback on Tuesday, rising nearly 0.8% and surpassing $2,350 per ounce. This uptick follows a sharp decline on Monday. The rebound was fueled by a weaker U.S. dollar and muted Treasury yields after the release of mixed U.S. producer price index (PPI) data.

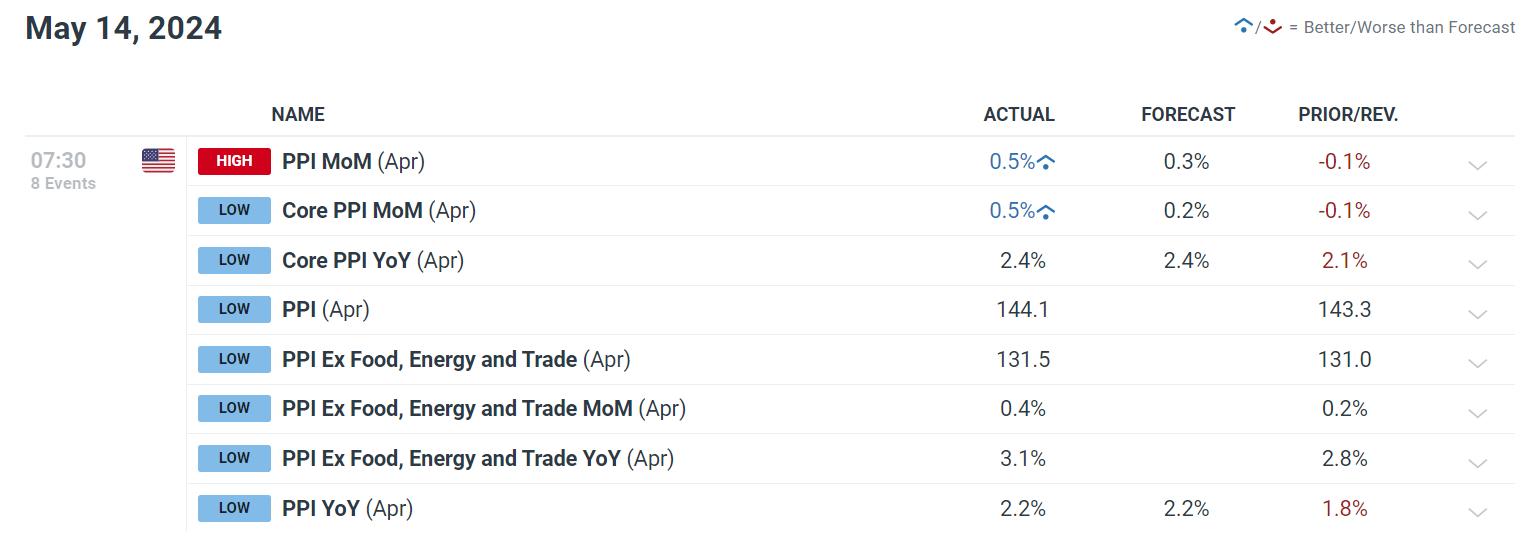

PPI data by dailyfx

While April’s PPI figures exceeded expectations, a downward revision from March helped temper the impact. Additionally, traders were relieved to see the gains primarily concentrated in portfolio management services, a sector with minimal influence on the broader economy. More importantly, several key PPI components factored into the core PCE deflator exhibited only modest increases, hinting that disinflationary trends might still be in play.

However, the true test for gold may come soon. PPI data can be complex to interpret due to its mix of signals. Investors are now eagerly awaiting the release of the Consumer Price Index (CPI) report on Wednesday morning for a clearer picture of inflation. Analysts anticipate both headline and core CPI figures to inch up 0.3% month-over-month, pushing annual inflation down slightly to 3.4% and 3.7% respectively.

A weaker-than-expected CPI report could reignite hopes of disinflation, strengthening the case for the Federal Reserve’s first rate cut of the year in September, a possibility currently sitting around 50%. This scenario would likely be positive for gold prices. Conversely, a hotter-than-anticipated CPI could trigger expectations of a more aggressive Fed stance, boosting the U.S. dollar and putting downward pressure on precious metals.