In the midst of the Asian trading session on Monday, gold prices, denominated in USD (XAU/USD), experienced a downward trend. This decline came as a response to the Federal Reserve’s (Fed) hawkish stance, which ignited speculation that the central bank could postpone its plans for easing monetary policies. As a result, the US dollar surged, exerting pressure on gold prices.

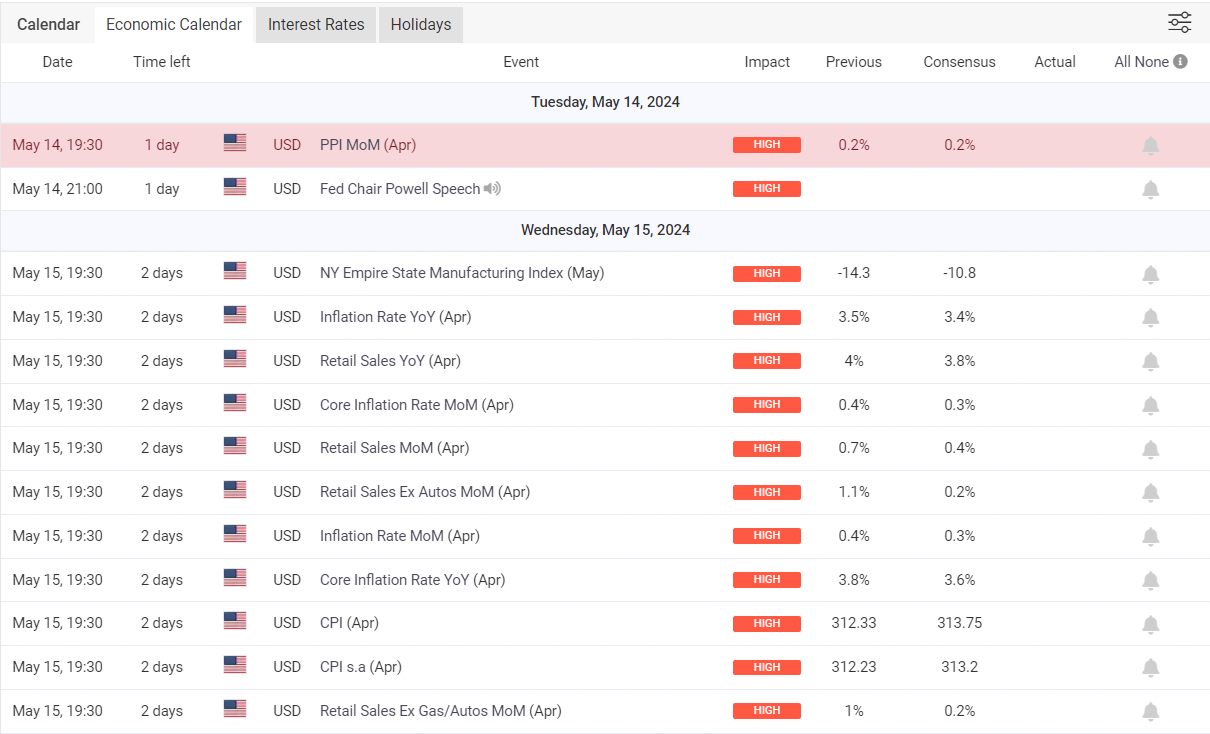

The Fed’s Jefferson and Mester are set to deliver speeches on Monday, drawing keen attention from gold traders as they seek insights into the central bank’s future monetary policy decisions. Additionally, the upcoming release of key economic indicators, including the US Consumer Price Index (CPI), Producer Price Index (PPI), and Retail Sales later this week, looms large. Should these data points reveal stronger-than-anticipated figures, it could further diminish expectations of a Fed rate cut, thereby adding to the downward pressure on XAU/USD.

UP COMING HIGH IMPACT US NEWS

ECONOMIC CALENDAR by myfxbook

However, amidst the backdrop of economic fragility and escalating geopolitical tensions in the Middle East, the outlook for precious metals remains somewhat bolstered in the short term. These factors are likely to provide some support to gold prices despite the prevailing headwinds from the Fed’s stance and economic data uncertainties.