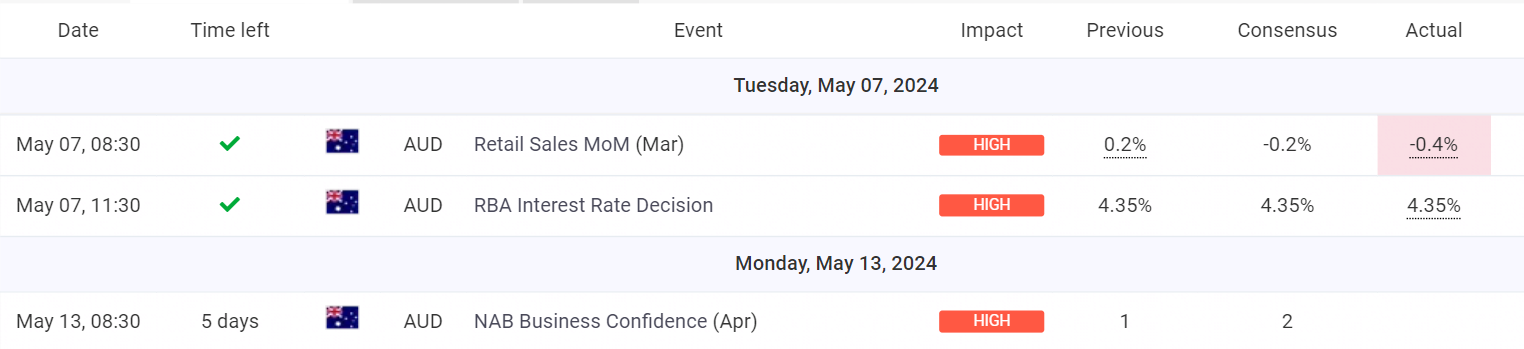

In a widely anticipated move, the Reserve Bank of Australia (RBA) opted to maintain the Official Cash Rate (OCR) at 4.35% following its May monetary policy meeting held on Tuesday. This decision marks the fourth consecutive meeting in which the RBA has chosen to hold rates steady, following a 25 basis points (bps) increase in November 2023.

ECONOMIC CALENDAR RELATED TO AUSSIE DOLLAR (by myfxbook)

Market expectations were largely aligned with the RBA’s decision, resulting in minimal surprise among investors. Consequently, the Australian Dollar experienced a slight downturn in response to the anticipated pause, with the AUD/USD pair depreciating by 0.40% on the day, hovering around the 0.6600 mark.

Australia’s fight against inflation is proving trickier than anticipated. While price increases are moderating, they’re declining at a slower pace than the RBA had hoped. This, combined with the uncertain global economic outlook and persistent inflation in service sectors, casts some doubt on the speed of Australia’s return to price stability.

The RBA acknowledges the recent data and emphasizes its cautious approach. They remain vigilant against potential risks that could push inflation higher and are keeping all options open for future interest rate decisions. This suggests the Bank may need to take a slower approach to lowering rates, prioritizing inflation control over economic growth in the short term.