In the European session, the EUR/USD pair regained momentum, climbing above the 1.0700 mark. Eurostat’s latest report revealed that the annual Core HICP inflation slightly decreased to 2.7% in April from March’s 2.9%, beating market expectations of 2.6% and bolstering the Euro.

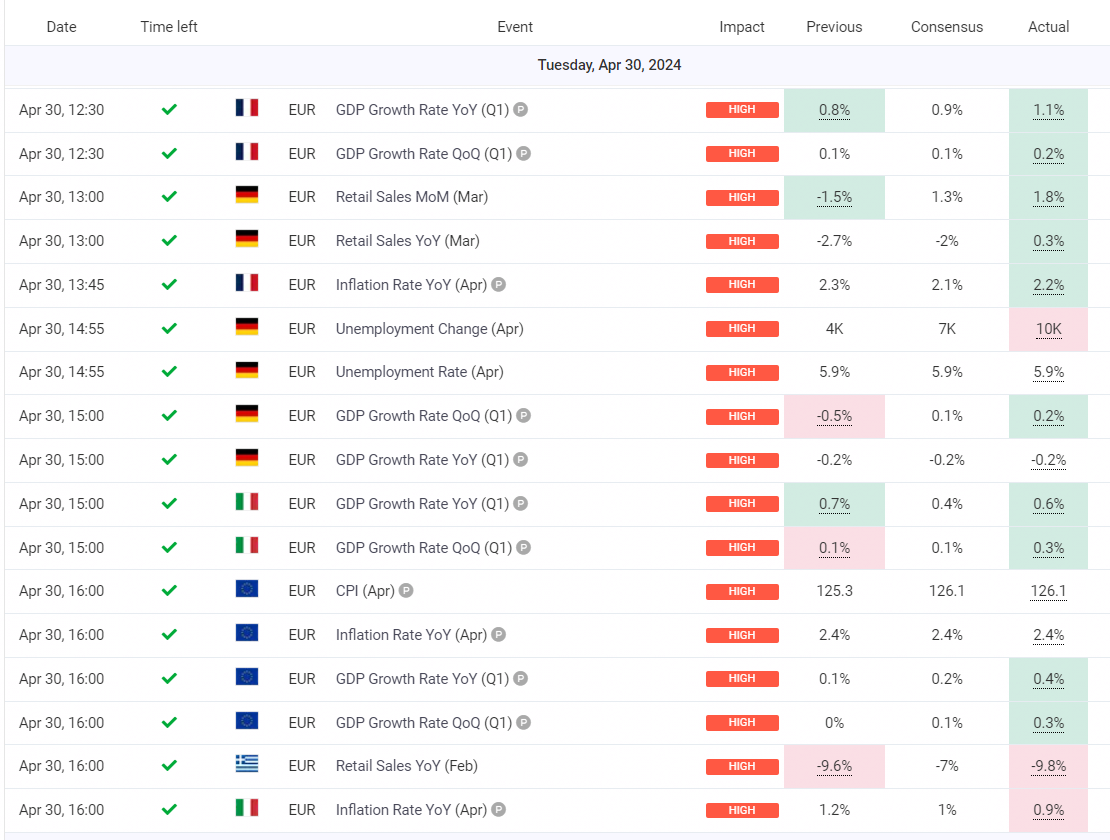

Economic Calendar by myfxbook

While the EUR/USD initially lost ground during early European trading, it rebounded after dipping below 1.0700, buoyed by positive data releases from the Eurozone. Germany’s GDP contracted by 0.2% annually in Q1, meeting market forecasts, while Eurostat reported a 2.7% year-on-year increase in the core Harmonized Index of Consumer Prices for April, surpassing expectations. Additionally, Eurozone GDP grew by 0.4% year-on-year in Q1, exceeding analysts’ projections of 0.2%.

These figures indicate that the European Central Bank (ECB) may adopt a wait-and-see approach, especially after its June policy rate cut. Consequently, the Euro remains resilient against its counterparts in European trading.

Later in the day, market participants will closely monitor the US first-quarter Employment Cost Index data. A higher-than-expected increase could bolster demand for the US Dollar in the latter part of the day. However, investors are likely to withhold significant positions until the Federal Reserve announces its monetary policy decisions on Wednesday.