In the latest financial news, the Australian Dollar (AUD) has seen a consecutive rise, driven by increased risk appetite. This positive trend follows easing tensions in the Middle East, with an Iranian official indicating no immediate retaliation plans against Israeli airstrikes, as reported by Reuters.

Boosting the AUD further, Australia’s Judo Bank Purchasing Managers Index (PMI) data for April was released on Tuesday. The Composite PMI hit a two-year high at 53.6, signaling significant expansion in the Australian private sector, particularly in services.

Economic Calendar by fxstreet

Meanwhile, the US Dollar Index (DXY) is under pressure despite higher US Treasury yields. The likelihood of unchanged interest rates in June has increased to 84.4%, according to the CME FedWatch Tool, with Federal Reserve officials hinting at a more hawkish stance on interest rates.

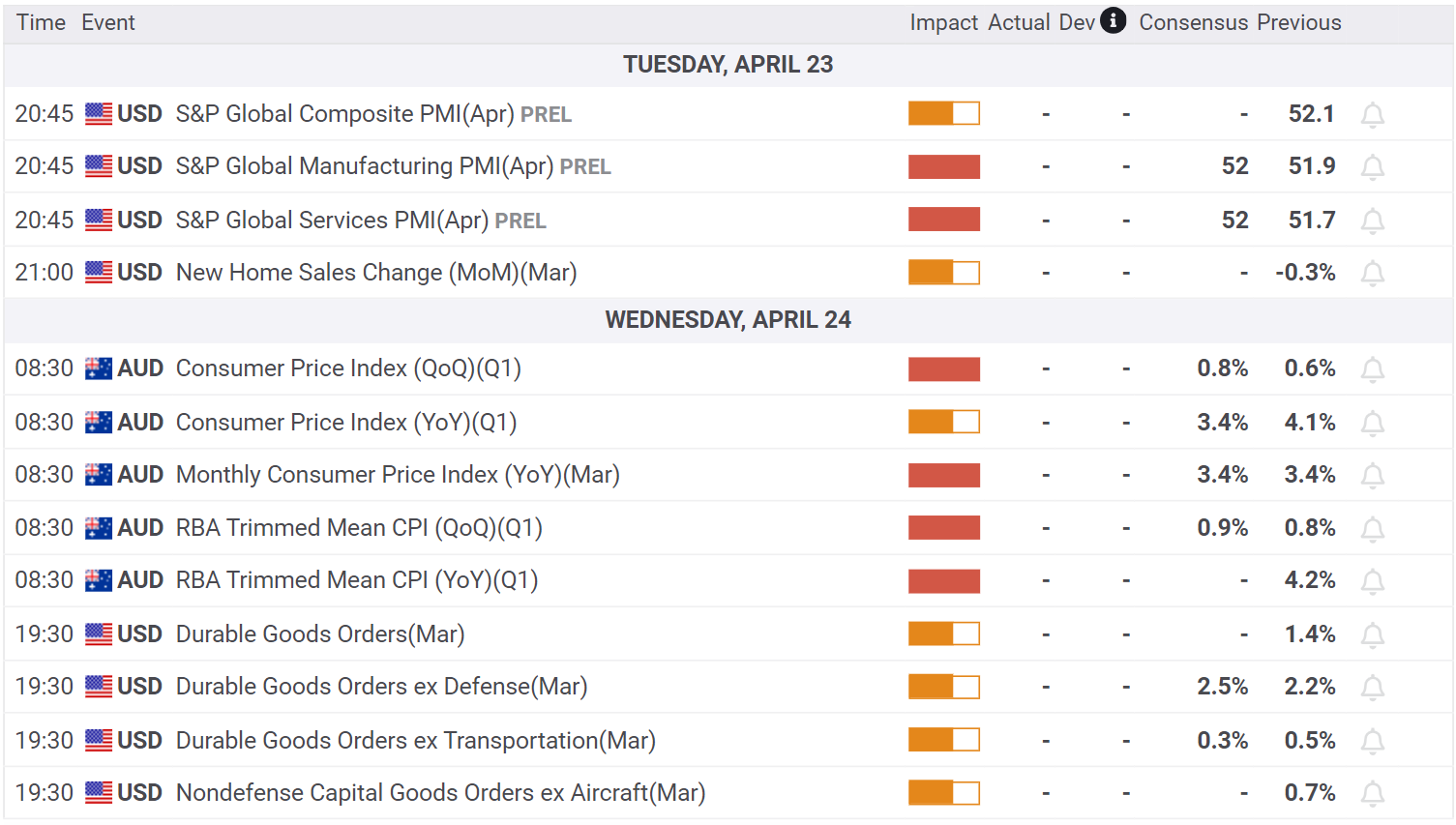

Investors are eagerly awaiting the US S&P Global Purchasing Managers Index (PMI) for April, anticipating improvements in both manufacturing and services sectors. Attention will then turn to Australia’s Monthly Consumer Price Index and quarterly RBA Trimmed Mean CPI data on Wednesday.

Upcoming Economic Data Release