Get ready for a busy week in the markets! Traders will be juggling geopolitical news, key economic data, company earnings, and central bank announcements. Staying on top of these events is essential for traders who want to profit from market swings and manage their risks.

Focus on Key Economic Indicators This Week

The next week is packed with important economic news that could affect how investors feel about the market. Especially important are the US economic growth (GDP) numbers for the first three months of the year and inflation data (core PCE) from March, which the Federal Reserve pays close attention to. Because recent data on retail sales, consumer prices (CPI), and producer prices (PPI) has been strong, these upcoming reports could be even better than expected.

If the data comes in stronger than predicted, investors might decide that the US economy is still doing well and that inflation is not going down easily. This could lead to a change in what people expect, with investors thinking the Fed will keep interest rates high for a longer time and not lower them as much as they thought before. This would be good for US interest rates and the US dollar.

Companies Report Financial Results: Earnings Season

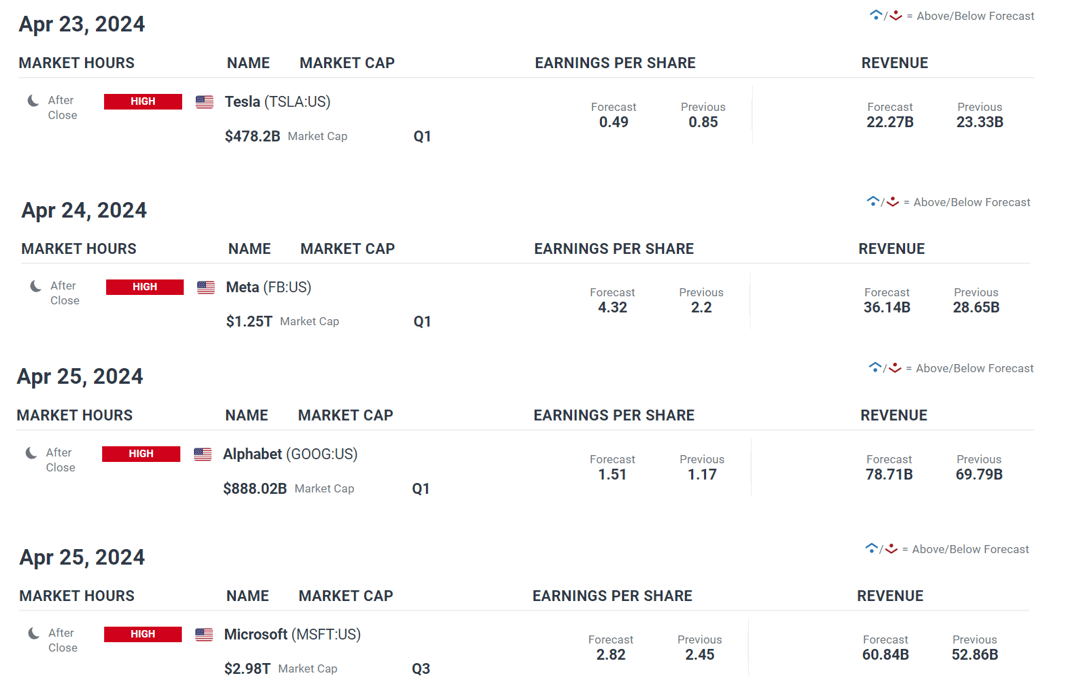

Big tech steps into the earnings spotlight this week. Tesla, Meta, Alphabet, Amazon, and Microsoft will unveil their financial performance, providing a glimpse into the health of major corporations. If these tech giants report strong earnings, it could boost investor confidence and lift the stock market. However, if their results fall short, it might raise worries about future economic difficulties.

Economic Calendar by Dailyfx

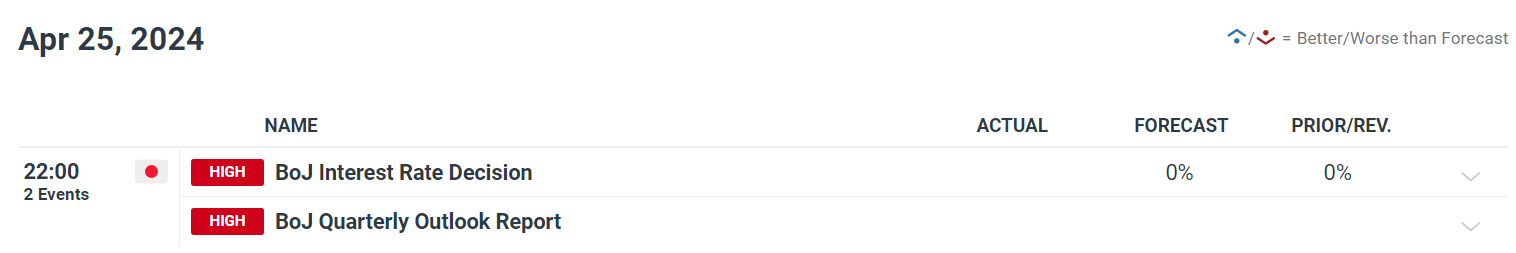

Central Bank Alert: Markets Watch for Bank of Japan’s Next Move

All eyes are on the Bank of Japan’s (BoJ) monetary policy decision this week. Investors will be dissecting the bank’s pronouncements to understand their position on raising interest rates. If the BoJ signals no immediate plans for further hikes, the Japanese yen could weaken further. However, the BoJ might take a somewhat more aggressive stance to counter the recent depreciation of the yen.

Economic Calendar by Dailyfx