In the Asian trading session on Thursday, the price of gold surged to an all-time high, surpassing the $2,300 mark. This significant uptick was primarily influenced by the release of weaker-than-expected US ISM Services PMI data for March, coupled with dovish remarks from Federal Reserve officials, which heightened expectations of a potential Fed rate cut.

The 14-day Relative Strength Index (RSI) on the daily chart indicates extremely overbought conditions, urging caution among gold buyers. Nevertheless, a daily closing above the $2,300 level could further bolster bullish sentiment, potentially targeting the psychological level of $2,350. Conversely, any downward correction may find initial support at $2,281, followed by the psychological barrier at $2,250, with a breach of the latter possibly leading to a sharp decline towards $2,200.

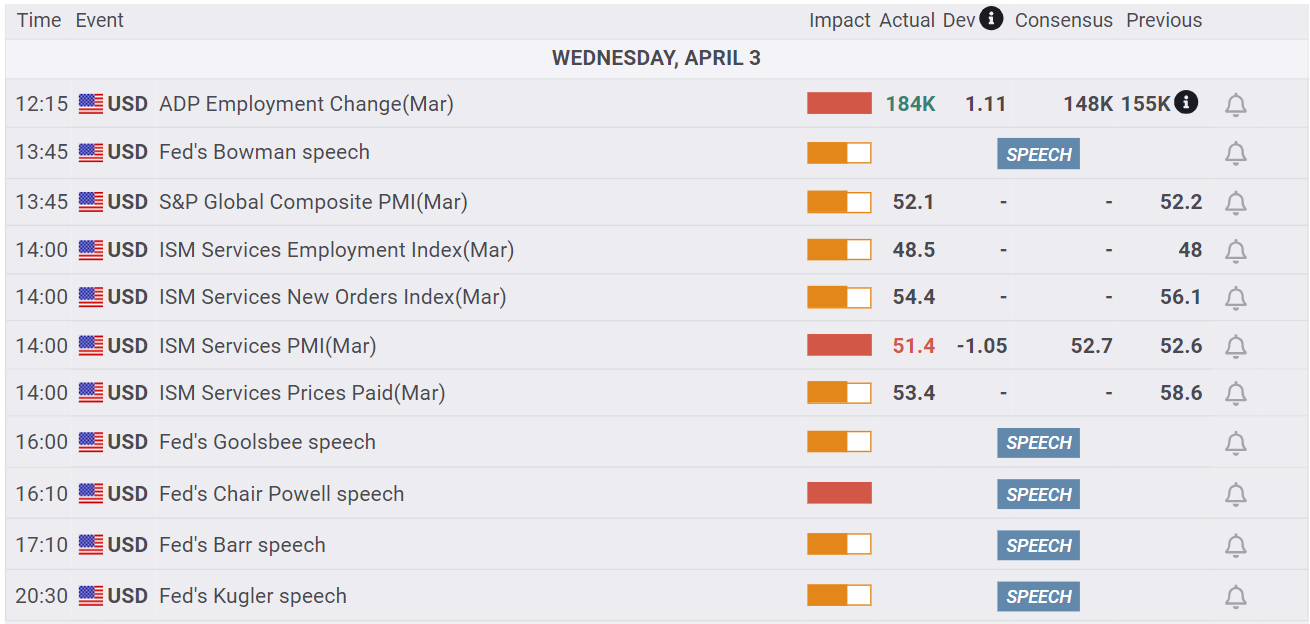

Economic Calendar on 03/04/24

US ISM Services PMI data for March declined to 51.4, alongside a drop in the Price Paid sub-index to 53.4, raising expectations of a dovish stance from the Federal Reserve. This led to lower US Treasury bond yields and a weaker dollar.

Powell’s recent remarks at Stanford hinted at potential interest rate cuts this year. Asian markets responded by driving gold to a new high. Concerns linger about sustainability, with traders eyeing US Nonfarm Payrolls data.

Geopolitical tensions in the Middle East could further boost gold prices. Investors await additional Fed comments and US Jobless Claims data, impacting expectations of a June rate cut, currently estimated at 62%.

Source: https://www.fxstreet.com/