After its two-day monetary policy meeting concluded on Tuesday, the members of the Bank of Japan (BoJ) board opted to increase the interest rate by 10 basis points (bps) from -0.1% to 0%, marking the first rise since 2007. This move marks the end of a period of negative interest rates that began in 2016. The decision aligns with what the market anticipated. The Bank of Japan (BoJ) announced changes to its monetary policy framework. Here are the key takeaways:

- The BoJ will target short-term interest rates as its primary tool, guiding them between 0% and 0.1%.

- It will continue large-scale bond purchases, though plans to gradually reduce buying of corporate bonds and commercial paper.

- The BoJ believes inflation will reach its 2% target by the end of the projection period and is considering unwinding some of its quantitative easing measures.

- The Bank will remain flexible and adjust its bond buying in response to market conditions.

- Overall, the BoJ expects to maintain an accommodative monetary environment for the time being.

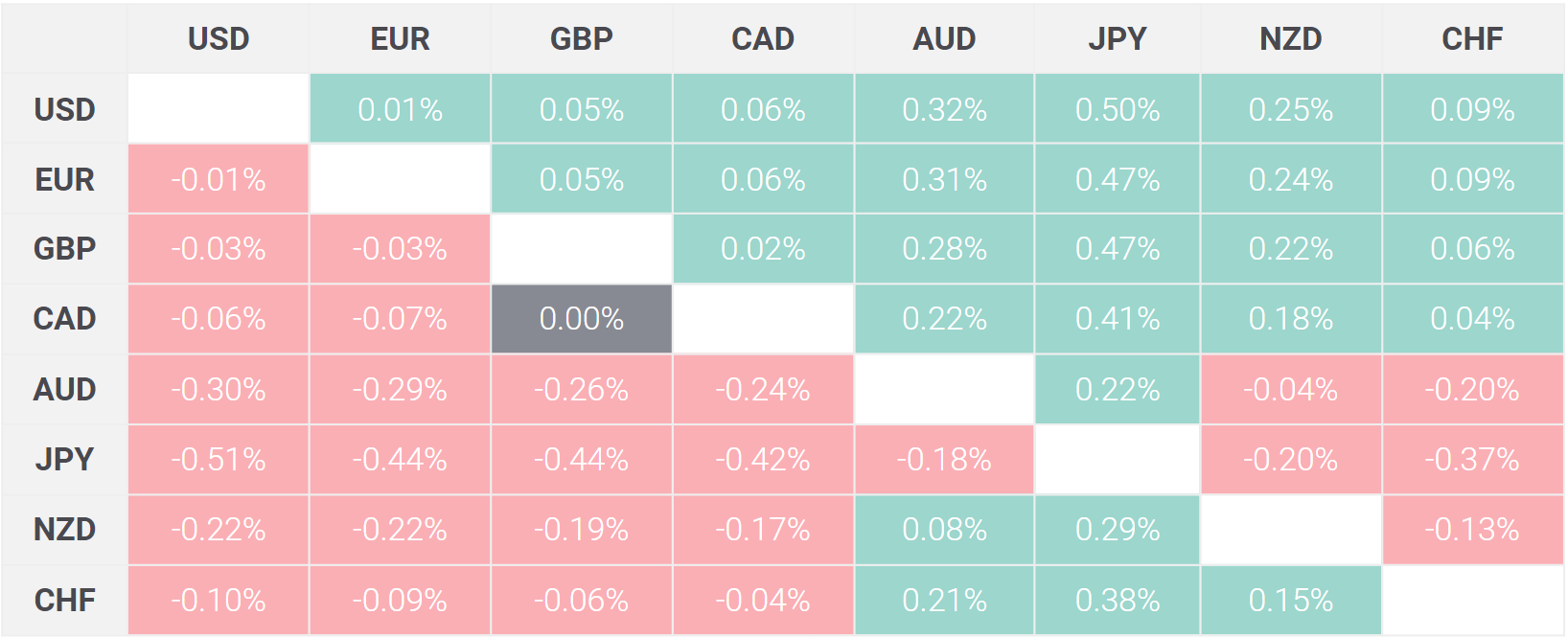

Japanese Yen price today

The following table illustrates the percentage fluctuation of the Japanese Yen (JPY) compared to various major currencies today. Among these, the Japanese Yen exhibited its lowest performance against the US Dollar.