This week witnessed a decline in gold prices (XAU/USD) by approximately 1.05%, reaching $2,155, driven down by the resurgence of U.S. Treasury yields and the strength of the U.S. dollar. Despite this setback, the precious metal maintains a robust bullish trend, evident from its March performance, which has resulted in a gain of approximately 5.5% and recent record highs.

Earlier in the month, gold prices surged on speculations surrounding potential interest rate cuts by the Federal Reserve. The momentum accelerated following remarks by Fed Chair Jerome Powell during a congressional hearing, suggesting a shift towards a less restrictive monetary policy stance as policymakers gain confidence in the inflation outlook.

However, recent sessions have witnessed a change in narrative following disappointing consumer price data, indicating a potential stall or reversal in disinflation progress. With inflation risks looming, as observed in recent CPI and PPI reports, traders may witness a shift towards a more hawkish stance by the central bank, signaling the need for patience before policy adjustments and potentially fewer rate cuts than initially anticipated.

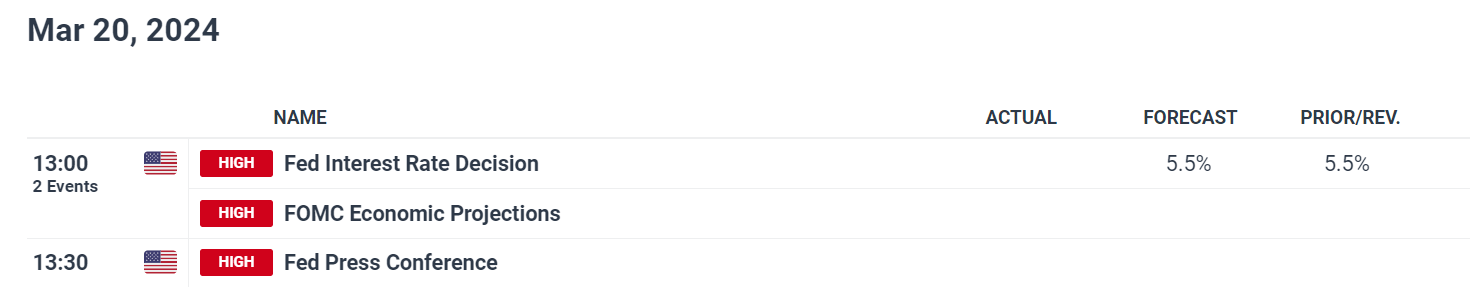

The Fed will announce its latest interest rate decision next week. While no change in rates is expected, the Fed’s comments on the economy will be closely watched for clues about future interest rate policy.

Source: https://www.dailyfx.com/