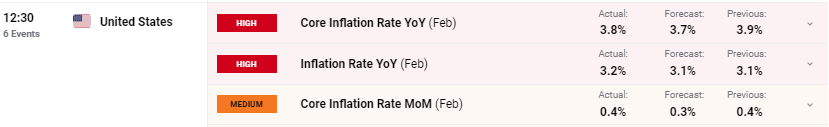

Inflation surprised economists for the second month in a row, exceeding expectations in February. This unwelcome trend is driven by rising gas and housing prices. Economists initially predicted a 3.1% inflation rate, but the actual figure came in at 3.2%. This persistence of higher inflation is concerning, as it suggests inflation may stay elevated for longer than previously anticipated.

Data by: DailyFX Economic Calendar

The Federal Reserve is keeping a close eye on inflation. Their decision to lower interest rates, currently at a 23-year high to combat inflation, hinges on seeing inflation slow down. While there is a slight decrease in core inflation (excluding food and energy), the drop wasn’t as significant as expected. This hints that inflation might be more resistant to control than the Fed had hoped, potentially delaying a decrease in interest rates.

Source: https://www.investopedia.com/