This week is shaping up to be a volatile one in the financial world, with a series of high-profile events poised to influence markets across asset classes. Here’s a breakdown of the key catalysts to watch:

Key Events Impacting Financial Markets This Week

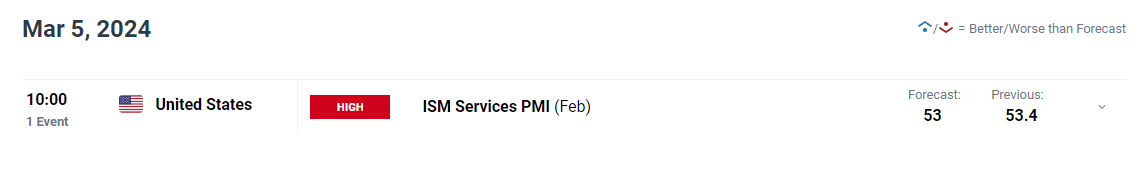

March 5th:

- U.S. ISM Services PMI (February): This crucial data release provides a snapshot of the health of the dominant U.S. service sector. A significant deviation from the projected modest decline to 53.0 could trigger sharp movements in the U.S. dollar (USD). Why? It could sway investor expectations regarding the Federal Open Market Committee’s (FOMC) future interest rate decisions. A stronger-than-expected reading might delay rate cuts, strengthening the USD. Conversely, a weaker reading could fuel anticipation of an earlier easing cycle, potentially weakening the dollar.

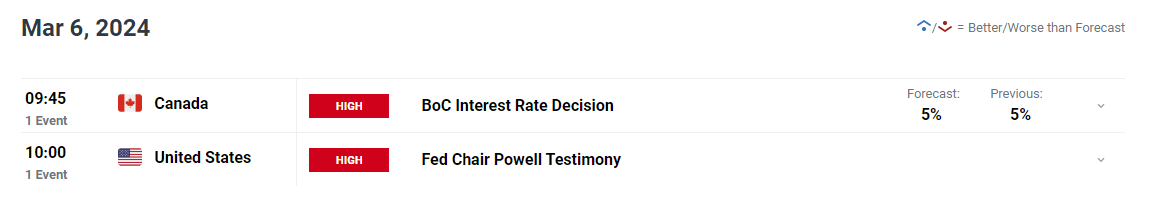

March 6th:

- Bank of Canada (BoC) Interest Rate Decision: While no change in rates is expected, the BoC’s tone on future monetary policy holds significant weight. Investors will be closely scrutinizing the language used to gauge when the bank might shift gears and begin raising rates. Any surprises here could cause significant volatility for the Canadian dollar (CAD).

- Fed Focus: Watch out for Fed Chair Jerome Powell’s Semiannual Monetary Policy Report to Congress followed by his testimony before the House Financial Services Committee. This is a golden opportunity for investors to glean further insights into the Fed’s current thinking, particularly regarding the timing of potential rate cuts. His stance could influence the USD and broader market sentiment.

March 7th:

- European Central Bank (ECB) Decision: No rate changes are anticipated from the ECB, but recent weak economic data from the Eurozone might tilt them towards a more dovish stance. Any hints of potential near-term rate cuts could exert downward pressure on the euro (EUR).

- Powell’s Testimony Redux: While Powell is scheduled to deliver his Semiannual Monetary Policy Report to the Senate Banking Committee today, this event is likely to be overshadowed by his more comprehensive testimony on Wednesday.

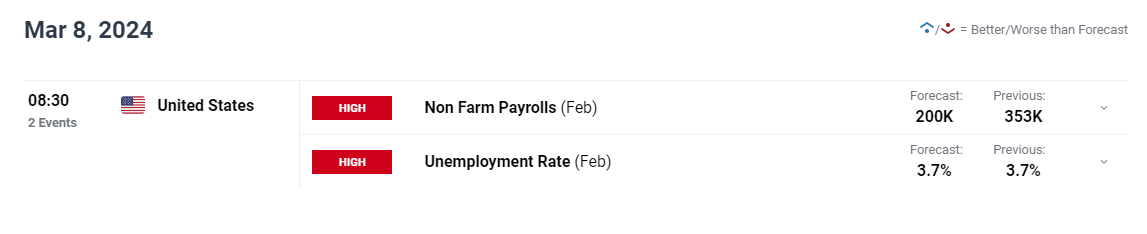

March 8th:

- U.S. Nonfarm Payrolls Report (February): This highly anticipated report reveals the number of new jobs added to the U.S. economy in February. While forecasts point to a gain of 200,000 jobs, recent history suggests potential upside surprises.

- A much stronger-than-expected report could signal a robust labor market, potentially delaying the Fed’s easing cycle and strengthening the USD. This would likely be negative for gold and risk assets (stocks).

- Conversely, a disappointing jobs report could accelerate expectations of a more dovish Fed, sending interest rates and the USD down, while potentially boosting gold prices.

In essence, this week holds the potential to significantly impact financial markets. Closely following these events and their implications will be crucial for navigating the potential volatility ahead.

Source: https://www.dailyfx.com/